Home Blog

PLP Leadership on the ground at UB echoing the message “Choose...

PM Philip Davis KC on the ground at the University of the Bahamas on Thursday.

Prime Minister Philip...

Marine Vann Miller faces five counts of having sex with a...

MARINE HAD SEX WITH THE TEEN IN PASTOR LYALL BETHEL CHURCH YARD - WHAT IN DA HELL IS THIS?!

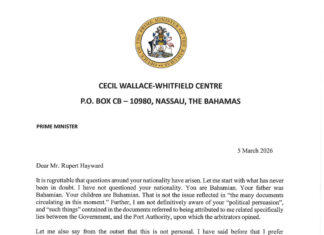

PM Philip Davis KC writes Rupert Hayward of GBPA

March 5, 2026

Dear Mr. Rupert Hayward,

It is regrettable that...

THE $5 MILLION QUESTION AND THE SHADOW OVER MICHAEL PINTARD

Opposition Leader Michael Pintard

NASSAU| In politics, the line between a “campaign contribution” and “corporate capture” is very...

PM DAVIS: $650 million investment featuring some of the largest floating...

PM DAVIS: Grand Bahama is building real momentum, and the expansion of the Grand Bahama Shipyard is...

Wicked Media Lies and Distortions

GBPA Office Complex in Freeport Grand Bahama

The Editor Bahamas Press 4th March 2026

Dear BP.

PRIME MINISTER DAVIS PUTS PENSION SECURITY FIRST WITH A NEW LEGISLATIVE...

Prime Minister and Minister of Finance Hon. Philip Brave Davis KC.

NASSAU| In order to ensure the long-term...

IS FNM IN TROUBLE ON LONG ISLAND?

Long Island FNM MP Adrian Gibson

by Bahamaslatest.com

CLARENCE TOWN, Long Island – The political landscape...

THE LIGHTBOURNE FAMILY RECEIVES THEIR OWN LIVING SPACE – PM DAVIS...

More new homeowners for Bahamians EMPOWERED BY Philip BRAVE DAVIS!

https://www.youtube.com/watch?v=msZ_hHAQ0e0

NASSAU| The young...

Prime Minister Davis On GBPA Arbitration Ruling – March 4th, 2026

Prime Minister Philip Davis’s House of Assembly Communication on the Ruling in the Arbitration between the Government of The Bahamas and The...

PRIME MINISTER DAVIS’S CONTRIBUTION ON THE COMMONWEALTH OF THE BAHAMAS 2025/2026...

PM Philip Davis KC

IntroductionMister Deputy Speaker:Today, I rise to present the Mid-Year Budget Communication for Fiscal Year...

Prime Minister Philip Davis’s National Address on the Tribunal Ruling in...

Prime Minister Philip Brave Davis KC

My fellow Bahamians,

Tonight, we can celebrate a historic...

Progressive Liberal Party’s Response to Michael Pintard on the GBPA Arbitration

GBPA has a liability to pay the Government annually until 2054

https://www.youtube.com/watch?v=vZbgDNWjInQ

STATEMENT: Michael...

Bahamas Government final say on Grand Bahama! GBPA counterclaim of $1...

https://www.youtube.com/watch?v=UDQA-6nGmvU

https://www.youtube.com/watch?v=rF4aZXIzeFk

Prime Minister Davis on the passing of V. Theresa Burrows

STATEMENT: Ann and I extend our deepest condolences to the family, friends, and colleagues of V. Theresa...

PM DAVIS ON THE POSSIBLE OIL CRISIS: WE’LL BE CUTTING TAXES...

NASSAU, Bahamas – As the Middle East enters a period of intense volatility following the joint U.S.-Israeli strikes...

Government of The Bahamas Statement on the Historic Ruling, Tribunal Confirms...

Grand Bahama Port Authority

Nassau, Bahamas – The Government of the Bahamas confirms that the arbitral tribunal has...

TUC President threatens to sue Chief Labour Consultant Bernard Evans and...

Bernard Evans, Obie Ferguson and Howard Thompson

NASSAU| Trade Union Congress (TUC) President Obie Ferguson says he intends...

PM DAVIS: GRAND LUCAYAN IS ENTERING EXECUTION PHASE

PM Davis

ABRAHAM’S BAY, Mayaguana – Highlighting a weekend of national progress, Prime Minister...

BIOMETRIC VOTER CARDS ROLLOUT BEGINS IN THE BAHAMAS, VOTERS MUST COLLECT...

Prime Minister Philip Davis and his wife Mrs Ann Marie Davis Verifying for their new cards.

NASSAU| The...

New School to train Bahamians in AI and Electric Vehicle Repairs…

https://www.youtube.com/shorts/33Y3iBhRDQ8

Expanding opportunity means creating real pathways for Bahamians to earn, grow, and build lasting careers, and...

Davis set to deliver an historic election victory!

Young liberal leaders gathered for another powerful weekend with PM DAVIS

BP Breaking| Prime Minister Philip Edward...

DAVIS delivers spanking new Mayaguana Airport for the people in MICAL

PM DAVIS: This weekend in Abraham’s Bay, we opened the new $2.1M Mayaguana International Airport terminal.

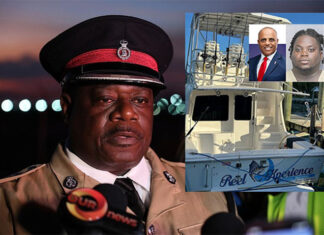

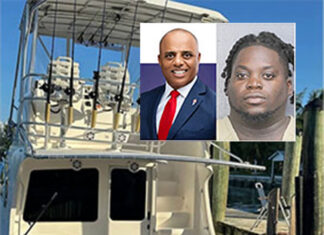

Curtis Trial Date is March 1, 2027 and Marvin Dames vessel “Reel...

How does a former Minister and MP and SENIOR POLICE get caught up in all this WICKEDNESS?!

Elvis...

Theresa Burrows passes at 74

Theresa Cargill- Burrows

NASSAU| Former PS, former Acting Director at the National Insurance Board, Deputy GM at...

Mother who lost child in private medical centre awarded $186K

File Photo

NASSAU| A mother whose baby died in 2012 during childbirth was awarded $186,000 after a judge...

Rupert Roberts SuperValue store owner airlifted to Minnesota!

Rupert Roberts

NASSAU| The SuperValue store owner needs all our prayers as he is now in intensive care.

Who will question Marvin Dames following that inbound supply of cocaine...

Marvin Dames and his Cocaine Captain Malcolm Goodman now in the custody federal authorities

Dear Editor,

Massive Road Construction Continues on Cat Island…

https://www.youtube.com/shorts/ciGHvco7IPY

CAT ISLAND| Bahamas Press is now following more capital works on Cat Island which has a...

Marvin Dames: the cocaine trafficker Malcolm Goodman – WORKS FOR YOU!

Michael Pintard was advised by the highest levels of the FNM to remove Marvin Dames in Mount Moriah!