Nassau, Bahamas — Just over 30 companies have registered online for Value Added Tax (VAT) since the online registration was launched earlier this week.

The system was launched on October 13th and it is expected that all businesses meeting the taxable sales of $100,000 or higher within the next 12 months must complete registration by November 30th.

The online system allows for businesses to register for VAT and in the future, to file for VAT. Businesses under the taxable sales of $100,000 limit can still register voluntarily.

Financial Secretary John Rolle said the launch of the online system brings businesses a step closer to being ready for the implementation of VAT.

“We are on target to get all those businesses ready and the October 13th launch is in keeping with our timeline for implementation,” he said.

“We want all businesses to register so that if there are any concerns they can be adequately addressed in time before that end of November deadline. The portal makes it easy and convenient for businesses to register as they can do some from the comforts of their own offices, homes or even their smart phones.”

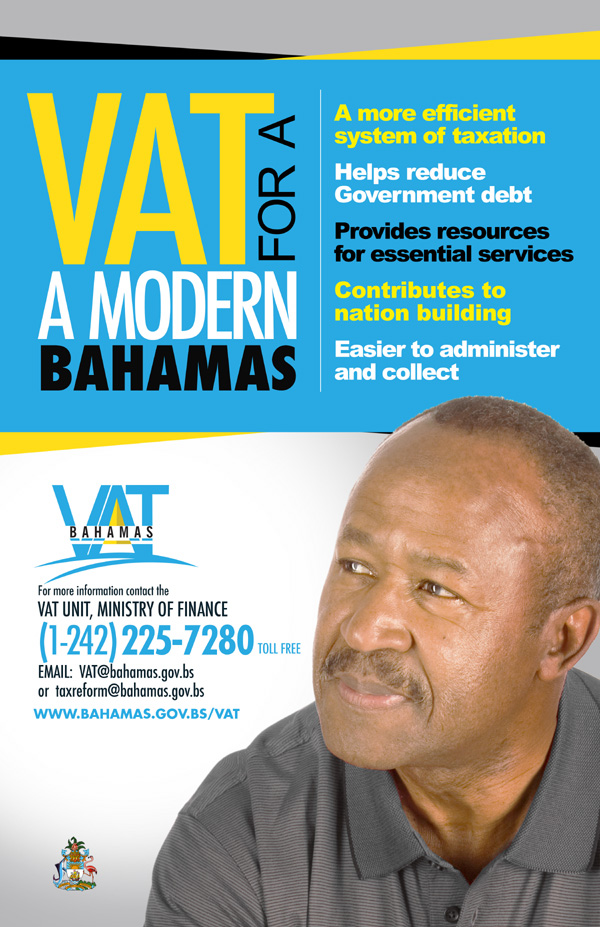

VAT is expected to come on stream on January 1st, 2015.

For more information contact the VAT Department at vatcustomerservice@bahamas.gov.bs or call the Help Desk Hotline 225-7080.

VAT REGISTRATION CHECKLIST

¨ Registered Business Name.

¨ Business Registration Number (available from Registrar General Department).

¨ Business National Insurance Number.

¨ Personal National Insurance Number.

¨ Business License Number and date Licensed Issued.

¨ Business License Control Number.

¨ Contacts Details: Name, Telephone Number, Email Address and Exact Business Address/Location (not registered office). (Please include secondary contact for emergency Purposes.)

¨ Additional Details: Branch Information with specific addresses for each branch, Shareholders, Directors, Partners & Trustee Information (if applicable)

Real Property Tax Assessment Number.

¨ Banking Information: Bank Name, Branch Location, Account Number, Account Type, and Credit Reference Letter. (Account related to your value added tax activities)

¨ Additional Information: Business Activity Details, Letter Authorizing a designated Representative (if required).

¨ Port Licensee Number (For Freeport only)

¨ Business Activities: Turnover