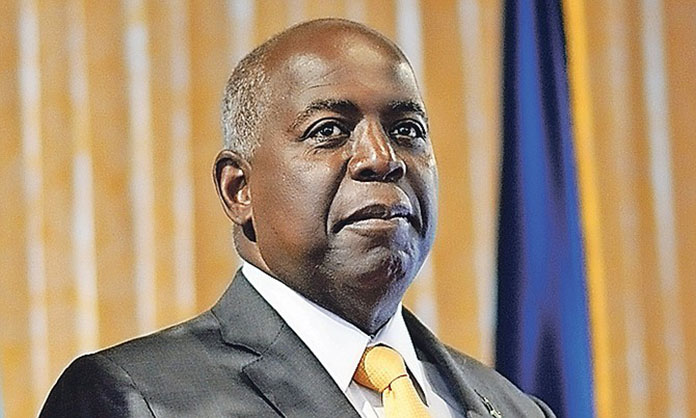

Nassau – Stating that the 2018/2019 Budget is void of any real economic growth, Opposition Leader Philip ‘Brave’ Davis is certain this is due in part to how the government has ‘dismantled’ the Revenue Enhancement Unit (REU) causing revenue collection in the country to suffer.

According to Davis, the REU was established within the Ministry of Finance and was responsible for collecting additional revenue in the sum of $25 million to $30 million per month. Their work, he said, was even commended by international credit rating agencies. This unit, he advised, despite false comments that it was floundering, was doing very well. However, he said the new Minister of Finance has ‘dismantled’ the unit and now revenue collection has suffered.

“This budget is void of any significant initiative to promote growth of the Bahamian economy,” he said. “The only reference to growth projects in this budget is attributed to Bahamar. This is significant as growth of the economy provides the impetus for revenue expansion and reduces the need for such burdensome taxation.”

He noted that world renown economic tax consultants identified collection gaps between $400 million and $600 million in the nation’s tax system. Therefore, the REU was tasked to pursue collection to close the huge gap. “The government has gotten its whole approach to the 2018/2019 proposed budget entirely wrong to the extent that it is creating widespread dismay in the business community, the public at large, and among local and foreign investors, “ Davis said. “It has done so without any consultations with any of its key stakeholders. There is an expression that is apt here: what it took centuries to build can be exploded in less than a minute. This, I fear is where we are heading.”

The Opposition Leader is fully convinced that if those measures the PLP had left in place, were vigorously pursued by the FNM, the Bahamian people would not have to bear a tremendous tax burden which they are now seeking to impose. When the previous administration left office, the REU was hardly floundering, he said, the program was stopped, cancelled and reviewed with most of the staff, who were well trained…..being terminated. “Concerning the Customs Department,…..under the leadership installed by the current administration, they stopped cooperating why?” he said. “Was it because the program was too successful and impacting politically sensitive companies?”

Additionally, Davis revealed that independent assessments on Real Property Tax identified some 2000 unregistered commercial and ‘highend’ properties in New Providence. He explained that once registered, this would yield an additional $30 million annually in Real Property Tax revenue to the public coffers.

“But registration mysteriously did not take place,” he said. “Why is that? Did politics play a role in this?”

END—-