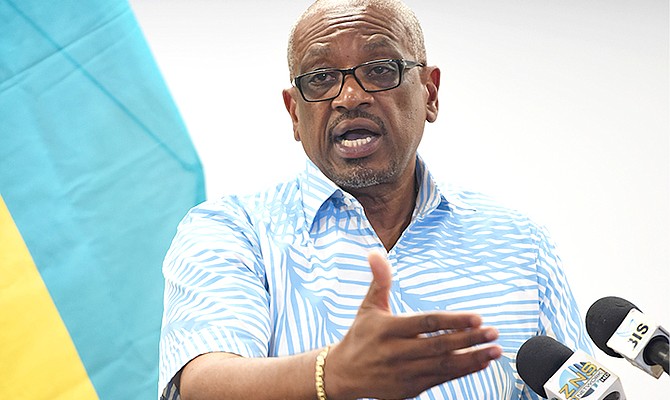

NASSAU| Former Prime Minister Hubert Minnis, who was kicked out of power back in September 2021, is now raising a cane against the Davis Government’s scrapping of his “Economic Empowerment Zone” programme which he, his father and the Chinese greatly benefited from during his term in office.

Following a White Paper on the programme, the then-PM Minnis told Parliament in 2018 that “Through this initiative, the government of The Bahamas is introducing the concept known as the Empowerment Zone. This concept is well known throughout the world and relates to areas designated because of economic hardship for special incentives. “It is imperative that the zone ensures good corporate social responsibility, and also that there is a sunset clause,” he said.

But who really benefited from this programme of tax write -offs? In the list of property tax exemptions granted under the programme, Bahamas Press can confirm only 48 exemptions were granted.

A closer examination of the persons who benefitted, five (5) of the properties exempted under the tax write-off prigramme belonged to the former PM Minnis who got a total of $19,696.60 in taxes forgone from July 1, 2018 to June 30th, 2023.

Another 10 property exemptions under the ZONE Programme were granted to the father of the former PM, Mr Ranolph MInnis. He got $20,530.23 written off.

And then another 10 properties that were listed for tax write-offs were businesses belonging to the CHINESE businesses. $59,261 was their total of tax exemptions.

The remaining 23 properties in all of the over-the-hill programme were owned by some 11 persons. Only $49,010 was accounted for by these persons. IN SHORT THERE WAS NO GREAT IMPACT TO INNER-CITY RESIDENTS!

Interestingly, the Minnis Government never included depressed communities like Englerston in the Economic Empowerment Zone. This area included the bulk of small businesses and homeowners in New Providence.

In short, Minnis helped his father, the Chinese and himself in his Over-the-hill Economic Empowerment Zone Programme.