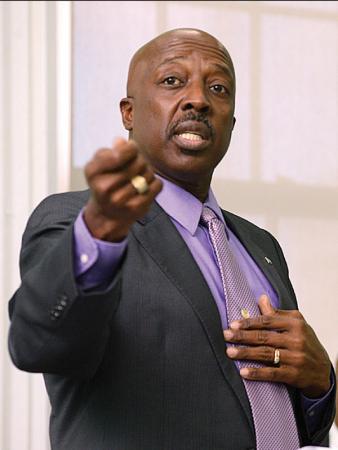

For Contribution to the House of Assembly by

The Hon. D. Shane Gibson, M.P., Minister of Labour & National Insurance

Mr. Speaker, since I tabled the 9th Actuarial Review of the National Insurance Fund (NIF) and the 2012 Annual Report of the NIF in this honourable place last Wednesday, there has been some discussion in the media, particularly on the findings contained in the Review. In light of the seemingly negative commentary, Management of NIB considered it prudent to emphasize the context and circumstances of the Review.

The review of the National Insurance Fund is a statutory obligation of the National Insurance Board. It is enshrined in section 48 (1) of the National Insurance Act that there shall be a Review every five years to, firstly, examine the operation of the National Insurance Act and secondly, to report on the financial condition of the Fund, including the adequacy or otherwise of contributions to support benefits and assistance having regard to the other liabilities of the Fund under the Act. The Review that was tabled last week, which is generating discussion, covers the period January 1, 2007 to December 31, 2011.

Let me say that again: The Review that was tabled last week, which is generating discussion in the media and elsewhere, covers the period January 1, 2007 to December 31, 2011. It was undertaken by Mr. Derek Osborne, former in-house Actuary and former member of the NIB’s executive management team during that period. The findings he advances in the Review are not reflective of the position of the Fund today, but rather as it stood at December 31, 2011. His recommendations were directed at addressing the issues he identified as existing on that date.

Having said that, however, it is still important that we address certain aspects of the Review which may lead readers or observers to misconstrue some of the key points arising from the former Actuary’s findings.

On the issue of NIB’s exposure to Government debt and its potential long term risk to the National Insurance Fund, I am advised that there was no Bahamian Government debt default during the review period. Further, the NIB has long recognized the need to diversify the Fund’s investment portfolio. The objective to reduce the allocation from Bahamas Government instruments to more offshore investments continues to be included in the organization’s strategic plans.

I understand the former Actuary’s concerns about NIB’s investment with Government but I can say that during my tenure as Minister responsible for NIB, both under the previous PLP administration and this current administration, Government-directed investment proposals were and are reviewed on a case by case basis and only those which satisfy the Board’s investment policy guidelines are approved. And I have to add that historically, investments in Government securities and properties have benefited the National Insurance Fund, particularly during the recent global economic downturn.

One of the dailies last week extracted part of the Review and married it with parts of the Annual Report; it was a marriage that should not have happened. It related to administrative expenses and reading it, one could have come away with the impression that something catastrophic happened in 2012 that caused administrative costs at NIB to jump by 45% in 2012. And knowing the heightened political climate under which we operate, we know what conclusion would have been reached. The Headline or rather the sub headline said, “…NIB “very inefficiently run”, as admin costs jumped 45% in ’12.”

Now, Mr. Speaker, the writer of this headline mistakenly or cleverly combined the opening of a sentence from the Actuarial Review with observations made in the Annual Report on the variance between key performance indicators for 2011(restated) and 2012. It was the Annual Report that listed a 45% jump in admin costs, and that same report, in more than one place – once by the Actuary and again by the Auditors – was careful to explain the reason for such a seemingly huge increase in expenditure.

Note 2. (l) to the Consolidated Financial Statements, December 31, 2012, explains that due to a revision in International Accounting Standards 19 and the adoption of the same for the 2012 fiscal year, the opening and closing balances for administrative expenses for 2011, as they relate to the NIB’s employee pension plan, were restated. Further the change in the accounting treatment resulted in a significant increase in the staff pension plan expense for 2012. If this change had been excluded, the increase in administrative expenses would be only 5.8% a difference of 39.2%.

And let me add, that this change in accounting treatment happened early in 2012, well ahead of that catastrophic (for some) day in May. Enough said about that!

Mr. Speaker, germane to the mission of the National Insurance Fund is the collection of contributions. Contributions fuel everything NIB does. Laudably, contribution collections continue to increase every year since inception – with only one exception, and that was in 2008. This is a testament to the strength and ongoing viability of the program. But I must admit that NIB is challenged with compliance, and such challenges are faced by social security programs around the region, indeed around the world. Every Actuarial Review of the National Insurance Fund from Day One, has spoken to this issue and has made recommendations to address the problem.

With regard to the charge that NIB demonstrates a lack of political will to penalize business and the self-employed for failure to pay, the fact is, the National Insurance Act provides a means to address non-compliance. It provides that interest be assessed on all outstanding contributions, and this is the first offensive in the fight against non-compliance. The assessment of interest is automatic, transparent and consistently applied.

Continued non-compliance does, indeed, result in prosecutions as evidenced by the performance over the last several years. Between 2011 and 2012, for example, the National Insurance Board commenced prosecutions of some 1,509 cases. In addition, 133 matters were dealt with by means of civil recovery in the Magistrate’s Courts.

Mr. Speaker, NIB continues to take very seriously the issue of non-compliance. Our commitment in this regard was evidenced by the fact that the organization added to the Legal Department’s complement two qualified attorneys. Again, prosecution is a last resort but it is employed consistently where needed.

In addition, every day, employers and self-employed persons who find themselves in arrears are able to enter – in fact, are required to enter – binding installment agreements to payoff such arrears while keeping current with contributions.

Mr. Speaker, it is worth noting that the Review made the following observation: “Failure to regularly and consistently follow good governance practices, especially in the areas of human resources, awarding of contracts and investments, continues to affect the efficient and effective operation of the National Insurance Board.

It is clear to me and should be clear to all, that Mr. Osborne, having been part of the Executive Management Team for the better part of a decade and a half, was not only expressing his professional opinion as an Actuary, he was giving testament to his direct experience as a member of the team. This experience drew him to the inescapable conclusion that there was (and I am paraphrasing here) a “failure to regularly and consistently follow good governance practices….in the areas of human resources, awarding of contracts and investments… which impacted the efficient and effective operation of NIB”.

Mr. Speaker, it has only recently come to light that, notwithstanding the fanfare surrounding the implementation of the National Prescription Drug Plan, important governance requirements in the legislation were not activated.

Mr. Speaker, the National Insurance (Chronic Diseases Prescription Drug Fund) Act provides for the establishment of a high-level Strategic Planning and Evaluation Committee charged with the two-fold function of:

– undertaking assessments of the operation of the Plan in relation to its mandate, objectives and performance; and

– making recommendations for enhancing the efficiency and future development of the Plan.

Further, this same Act mandated that the first actuarial review of the Prescription Drug Fund should have occurred as at 31 December 2011. No preparations were made by the former administration to meet either of these obligations.

Compounding this governance deficit is the fact that the Prescription Drug Fund Act, surprisingly, makes no provision for statutory audits or for annual reports relating to the operation of the Fund. It may well be that the architects of the Plan assumed that these important controls would be subsumed within the processes and requirements of the National Insurance Act, but it appears that the legal mechanisms to ensure this were not provided for.

Mr. Speaker, much turbulence has engulfed the National Insurance Board organization in recent times. Not least of which were the Grant Thornton Forensic Audit which uncovered certain questionable practices at senior levels within the Board.

In response the Government appointed new leadership at the organization in the persons of Reverend Dr. James Moultrie as Chairman, and Mrs. Rowena Bethel as Director. Both Father Moultrie and Mrs. Bethel are renowned veterans in the field of public administration, each having a wealth of local and international experience in administration.

In addition, I am pleased to report that the Government, in its commitment to set the National Insurance Fund and the Prescription Drug Plan on the right path in a transparent and fair manner has:

– engaged with the International Labour Office to cause an actuarial review of the fund to cover the same period covered by the 9th Actuarial Review before you,

– in addition such engagement with the ILO is seeking simultaneously to satisfy the statutory obligation for the first actuarial review of the Prescription Drug Fund;

– moved to appoint the Strategic Planning and Evaluation Committee prescribed by the Drug Fund Act; and

– instructed the preparation of the necessary legislative changes to impose statutory requirements for the Prescription Drug Fund to be subject to annual audits and submission of annual reports.

Mr. Speaker, much effort and commitment is required to ensure that NIB satisfies its statutory mandate as the custodian of the funds to meet prescribed safety net contingencies for the workers and beneficiaries of its programs. The scope, range and impact of NIB’s activities, far exceed what the original architects of the program ever envisioned. But, Mr. Speaker, simply put, that is what progress and national development are all about.

To effectively meet the expectations and needs of its stakeholders NIB must transform and be more responsive, not merely in the services that it offers, but also in the way those services are managed and delivered.

Mr. Speaker, I am pleased to advise that greater focus is being directed towards establishing a robust and effective customer service unit, intended to provide a one-stop shop experience for NIB’s customers. This will, in part, be accomplished by more fully embracing available information and communications technology tools.

Mr. Speaker, successive actuarial reviews have urged the imperative to diversify the NIB’s investment portfolio to address safety, yield and liquidity criteria. To this end, in addition to closely examining updates to its investment policy framework, the Board will also be exploring options for a more conducive structure to better manage its growing real estate investment portfolio.

Mr. Speaker, I am a supporter of the need for good governance practices in any organization, but more especially in public sector organizations and endorse the ISSA Good Governance Guidelines.

These Guidelines (ISSA) present a governance framework that spans a range of governance issues. It recognizes accountability, transparency, predictability, participation and dynamism as core good governance principles. They recommend qualified persons be appointed to serve on Boards and in leadership positions and that there be clear roles for the Minister, the Board and management. These ISSA Good Governance Guidelines, prepared specifically for social security schemes, can help guide NIB’s transformation into a well governed, efficient and sustainable system.

Mr. Speaker, the new Director recently produced a governance document, she called a “Handbook”, based on the National Insurance legislation. The legislation provides for the framework that was put in place for NIB’s administration by the ILO back in the early seventies. This Handbook laid out the governance framework under the national insurance legislation, which clearly sets out distinctly separate, but complementary, roles for the Minister, the Board and management. Perhaps, Mr. Speaker, over the years there has been a departure, sometimes fundamental, from those governing principles clearly laid out in the law by the ILO.

While there is no question that laws should be updated to remain relevant, some of the issues that seem to have arisen at NIB in the past, in many instances can be attributable to the failure of those administering the national insurance program, to read, understand and implement the provisions of the governing law for its administration. In the absence of a clear understanding of the governing law, its governance framework and its context, there is bound to be confusion as to which actors have authority to execute certain functions mandated by law.

Against this backdrop, Mr. Speaker, a modern policy and procedures framework for the administration of national insurance is under construction. This framework will establish direct links back to the principles found in the national insurance compendium of legislation, as originally intended by the ILO advisors that set up the scheme. It is fully expected that this exercise may highlight areas of the law that either require updating or clarification; and consequent modifications will be made.

Mr. Speaker, it should be noted that confusions surrounding the essence of the national insurance program have tended to arise most often when NIB falls within the portfolio of the Minister of Finance, who, under the Act also pretty much directs the investments of the Board. By contrast there appears to be less misunderstanding when NIB, as originally established, falls within the portfolio of the Minister with responsibility for Labour or a Minister other than the Minister of Finance. This separation provides an inherent check on the behavior of the Minister of Labour by preserving the requirement that he always consult on investment matters with the Minister of Finance.

In the area of Industrial/Medical costs, several initiatives are being implemented that will improve efficiency and contain costs. Amongst these are the introduction of new IT systems, the recruitment of more claims adjudicators, and the hiring of additional pharmacists for the Prescription Drug Plan.

NIB currently enjoys alliances with Road Traffic Department, Business License, the Straw Market Authority and the Department of Immigration. We intend to explore ways to enhance these relationships and develop mutual alliances with other Government agencies and, indeed, non-government organizations as well.

We will be maximizing our use of information and communications technologies to better serve our external as well as internal customers, improve overall administrative efficiencies and drive down administrative costs.

NIB is fairly well advanced in examining and updating the pay system related to Performance Management, which is expected to positively impact the board’s ability to continue to attract and retain quality employees. The new system will be a set of practices that will help to ensure the following results:

1) Payroll costs are in line with the overall financial health of NIB.

2) Improve better overall management of the Board and higher performance levels.

3) Promote accountability

– See more at: http://myplp.org/2013/10/09/gibson-address-parliament-on-nib-actuarial-report/#sthash.GBx5JI6t.dpuf