COMMONWEALTH OF THE BAHAMAS

2013/2014

MID-YEAR BUDGET STATEMENT

ON THE SIX MONTHS ENDING 31st DECEMBER 2013

Presented to the Honourable House of Assembly

by

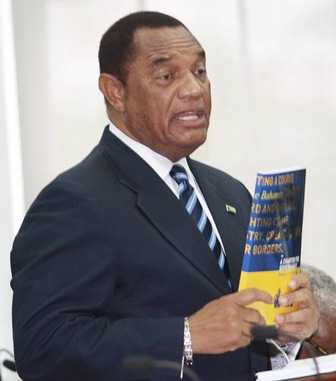

The Rt. Hon. Perry G. Christie, M.P.

Minister of Finance

on

Wednesday, 12th February, 2014

INTRODUCTION

I have the honour to present the Mid-Year Budget Statement for the six-month period ending December 31, 2013.

I want to open my remarks on this occasion by focusing first on the economy and jobs, for those are subjects that are very dear to our fellow Bahamians. Members will be aware that, just last month at the Business Outlook Conference, I shared my deep-seated optimism for our economic future, across the various key sectors of the economy and the breadth and width of our archipelago. As I laid out in detail in my speech that day, my Government has worked tirelessly over the past eighteen months to promote the further development and expansion of economic activity and the attendant employment opportunities. As I will touch on shortly, the economy is growing and unemployment is declining. We have clearly gotten through the worst of the global crisis and the future looks very bright indeed.

I would like to highlight a number of the major new developments and foreign direct investment projects that have resulted from our efforts, namely:

In Grand Bahama: a joint venture with the Sunwing/Blue Diamonds Group for a new four-star Memories Resort creating up to 1,000 jobs;

As well, Balearia plans to upgrade its existing 400 passenger ferry to a newer and larger 1200 passenger fast ferry, helping to restore Grand Bahama’s reputation as a “fun” destination;

The opening of the Island Outsource Contact Centre in Freeport, with a projected 200 employees by year-end, representing the first step in the establishment of a call centre industry;

We are in contact with the parties connected to the former Gin development in West End, with a view to reviewing the project;

We are also reviewing proposals to provide major attractions in Grand Bahama;

In Bimini: Genting’s Resorts World subsidiary has taken over management of the resort, opened a new casino and employed a staff of 500;

A deep water jetty is also under construction and the airport and other public works are being substantially upgraded and expanded;

A new five-star hotel is under construction and will open in May, employing 300 people;

The Abacos: the Baker’s Bay upscale residential resort continues to flourish and expand;

The construction of the new port in North Abaco and the improvements and opening of the new terminal at Marsh Harbour International Airport;

The Blackfly Fishing Lodge is in operation and the Sandpiper Inn should open this year, with 150 employed and more jobs to be created;

The Berry Islands and North Andros: the sale and continued development of the Chub Cay Resort;

Discussions are underway for the acquisition and development of Bird Cay and Whale Cay;

San Salvador and the Exumas: we put in place incentives and collective strategies to successfully address the concerns of Sandals Emerald bay and Club Med, protecting the jobs of hundreds of employees;

Club Med has joined with Canadian partners to cary out a $90 million refurbishment and expansion project at Columbus Isle Village and adjacent land in San Salvador;

Sand and Ocean is planning construction of a 125 room boutique hotel;

Two projects have just been approved for a boutique hotel near the landfall of Columbus and a residential development at the Columbus Landings subdivision;

The Norman’s Cay residential and resort project is in the advanced planning stage;

A group of U.S. investors is developing a small resort on Stocking Island;

Eleuthera: discussions are underway for the construction of a five-star resort at Cotton Bay;

New Providence: Atlantis is proceeding with $40 million in capital expenditures, including upgrades and refurbishment of the Cove Hotel and Royal Towers;

Albany will move ahead with its next phase of expansion, offering 1300 new jobs during construction and operational stages;

Mark Holowesko’s boutique resort is proceeding on schedule;

The Palms Hotel is being upgraded into a Courtyard Marriott hotel;

The purchase of the Hilton and South Ocean Beach properties should proceed in the ensuing months;

The new Baha Mar development will open at year-end, creating 5,000 new permanent jobs.

I also wish to highlight, at the very outset, that the Government’s fiscal plan is on target this fiscal year. Based on the fiscal results through the mid-year, we will meet the GFS Deficit objective for 2013/14 that we set out in last May’s Budget Communication. Moreover, I am confident that, through ongoing prudence in the management of our fiscal affairs through the end of June, we can in fact do better than our Deficit target this year.

I will shortly provide additional details on the performance of the various components of the fiscal accounts in the first half of 2013/14.

Prior to doing that, I want to take a moment to remind Honourable Members that the fiscal results on which I am reporting this morning are fully faithful to the medium-term fiscal consolidation plan that my Government unveiled at the time of the May 2013 Budget Communication.

Despite some reports to the contrary, we are indeed proceeding with a logical and well-structured plan of action. This plan originated prior to the last election, in our Charter for Governance, and it has continued to inspire our actions since we were entrusted with the governance of the Nation by the Bahamian electorate. This is a plan developed by the Bahamian Government to serve and advance the interests of Bahamians.

Despite the views expressed in some circles, ours is not a plan designed to placate any organization outside our borders, though I am confident that the beneficial results of our actions will be well received by such organizations. We are following through, with consistency and perseverance, on what we pledged we would do.

I want to reiterate again today, for the benefit of Bahamian citizens, that addressing the public finance challenge that we face is not an end in and of itself. Eliminating the Government Deficit and getting our Debt burden moving on a downward track is an integral part of my Government’s national development plan for stronger growth of our economy and more buoyant job creation.

As I have stated on previous occasions, successful and durable fiscal consolidation necessarily requires a fundamental restructuring of our fiscal and taxation policies. The details of that restructuring were laid out in the February 2013 White Paper on Tax Reform, and they were an integral part of the medium-term fiscal consolidation plan that I set out in the May 2013 Budget Communication. As the Government moves ahead with these fundamental reforms that it was elected to implement, it is crucial that focus be maintained on the overarching plan for economic renewal, job creation and social progress.

Our plan is multi-faceted and it is targeted to fighting crime and bolstering national security, strengthening the economy and creating jobs, enhancing health and education and social development generally as well as promoting the further development of our Family Islands.

The achievement of these objectives clearly rests on stronger economic growth going forward. To that end, our plan encompasses a variety of measures including strengthening our key tourism industry; promoting additional foreign direct investment across the country, and particularly in Grand Bahama and the Family Islands; exploring avenues for further diversifying our economy, especially in the agricultural area through science and technology to improve our competitiveness in food production.

We are also committed to further diversifying our financial services sector; the further development and expansion of our yachting and shipping registries; expanding our investments in education; and strengthening national training through the National Training Agency to establish a competency based training and job placement system that is flexible and responsive to the actual requirements of the workplace.

The Government is also taking steps to guarantee that the process of starting a business in The Bahamas is as straightforward as possible by removing common roadblocks that often hold people back. One of the key indicators of an efficient economy is the ease of doing business. This measure represents the efficiency of the Government in getting businesses up and running and actively contributing in a positive way to the local economy as quickly as possible. Currently, The Bahamas is too far behind other countries in the world in this metric, and steps are being taken to ensure that we are able to adequately compete in getting businesses up and running in an effective manner.

In October of last year, The Bahamas was one of only three countries in the region recognized by the World Bank for taking definitive steps to improve our business environment1. We were recognized for making transferring property easier by reducing the stamp duty. The Bahamas was also recognized for enhancing its insolvency process by implementing rules for the remuneration of liquidators, allowing voluntary liquidations and outlining clawback provisions for suspect transactions2.

We have focused our attention on these and the other major areas of our change and growth agenda and we will persist in planning and further developing initiatives that assuredly will get our economy growing more strongly in the years ahead.

From the outset, we have been guided by the hard reality that our plan could not simply be fueled by spending more money. As we came to office, it was clear that the finances of the Government needed to be returned to a position of sustainability if we are to strengthen confidence in the Bahamas as an attractive and secure place for investment, not only by foreigners but by Bahamian entrepreneurs as well. If confidence is eroded by lax fiscal policies, we all bear the consequences: credit downgrades and higher interest rates for the Government and Bahamian businesses and citizens, as well as the potential for further downgrades and higher rates if we fail to act decisively and stop mortgaging the future to support today’s spending.

Does any of this matter to the average Bahamian citizen? It most certainly does. For one thing, a high and rising burden of Government Debt chews up ever-increasing sums of our revenues merely to pay interest on the debt and to repay maturing debt. This FY, for example, fully 21 cents of every one of our revenue dollars must be siphoned off to debt servicing. That is money that is unavailable for other worthy and productive economic and social uses, such as education and training, health care and hospitals, etc.

High Government borrowings and debt also lead to higher rates of interest which affect the daily lives of all Bahamians, through higher monthly payments for consumer loans and mortgages. Workers’ pay packets are thus left with less money to cover ongoing and essential living expenses.

We therefore have been clear, since we came to office, that we would implement priority initiatives within our plan to the extent that we could do so in a fiscally responsible manner. We have also stressed that we would strive to reform and rebuild the basic structure of the public finances such that, over time, we return them to a self-sustaining basis with no need for annual deficit financing and borrowing.

At the same time, by putting the burden of government debt on a downward path back to more desirable and appropriate levels, we will recreate the fiscal room necessary to finance the full complement of our national development plan, including economic renewal and stronger job creation.

Seen in this light, fiscal reform is at the heart of the Government’s plan for national economic and social development. In turn, tax reform is a critical component of fiscal reform. These reforms are absolutely necessary to allow the Government to follow through in making its national development plan a reality.

A PLAN TO RESTORE THE PUBLIC FINANCES

In the Budget Communication last year, I set out the details of the various components of our fiscal reform strategy in the form of a Medium-Term Fiscal Consolidation Plan through 2016/17. The plan consists of four key parts: growing the economy; restraining expenditure; enhancing revenue administration; and securing new sources of revenue.

Through this plan, and in combination with our actions to strengthen economic growth, we are fundamentally and, in a balanced way, reforming the structure of both Recurrent and Capital Expenditure as well as the structure of Government Revenues.

This will allow us to:

– eliminate the untenable imbalance between Recurrent Expenditure and Revenue;

– eliminate the GFS Deficit; and

– arrest the growth in the Government Debt burden and move it onto a steady downward path to more sustainable levels.

On the Recurrent Expenditure front, we are taking a variety of measures to restrain the growth of spending and to make that spending more efficient and effective. The overall framework for strengthened public financial management is taking place within the scope of the new Financial Administration and Audit Act. The Ministry of Finance, in a determined fashion, is enforcing strict expenditure discipline and accountability across all Government Ministries, Department and public corporations.

In this regard, the Government is firmly committed to a fundamental review of its operations as well as its expenditure and revenue control mechanisms, seeking to instill best practices wherever feasible. The Ministry of Finance, in particular, is being restructured and strengthened in order to enhance its capacity to more effectively monitor the operations and expenditures of Government Ministries, Departments and public corporations. We are vigorously striving for higher levels of accountability and transparency.

As regards public corporations, the Ministry of Finance is exerting more direct oversight of their financial affairs to ensure that they strive for greater levels of efficiency and effectiveness and that they are subject to greater accountability to the Government. This will allow our budgeting process to be more comprehensively informed by the budgets of public corporations, and so that a truly comprehensive approach to fiscal discipline is achieved. The Government has asked subsidy dependent corporations to better align their expenditure plans with the resources that are available from Government.

As well, our planning function is being strengthened such that new investments and projects are reviewed in an economically and financially sound and effective manner.

Also under the Financial Administration and Audit Act, the government is introducing new Public Sector Procurement procedures which impose greater controls and greater efficiency on public spending for goods and services for all public entities including public corporations.

We have also bolstered our approach to the management of government debt. With technical assistance from the International Monetary Fund, we have established a Debt Management Committee comprising representatives of Finance, the Treasury and the Central Bank. Through this committee, a new debt management policy framework has been developed to minimize the financing costs of Government debt while also minimizing risk.

Through these actions, Recurrent Expenditure will be allowed to grow in dollar terms through the medium- term to allow the financing of new and emerging priorities such as the hiring of doctors and other staff for the new mini-hospitals. However, the plan does signal the Government’s commitment to a reduction in Recurrent Expenditure relative to the size of the economy; this will require the setting of clear spending priorities going forward. That will begin the longer term process of getting Recurrent Expenditure back to its level relative to GDP that prevailed during our first term in office.

Capital Expenditure over the last few years has been at exceptionally high levels relative to historical trends, well in excess of 4% of GDP. That has reflected important investments in public infrastructure that will underpin more buoyant economic growth in the coming years. However, due to the fiscal exigencies, our Medium-Term plan calls for these expenditures to be returned to their more traditional level of 3% of GDP. Given emerging requirements, this will require strict prioritization and timely profiling on the part of the Government.

The Government’s actions on the revenue front begin with measures to improve the collection of existing taxes in line what is rightfully due to the Government. Again, in spite of the misinformed and jaded assertions that have recently been advanced, we are fully cognizant that our revenue system is seriously deficient and we are actively moving to remedy this situation through a number of concrete measures.

In terms of the real property tax, for instance, we announced initiatives earlier this year to reduce arrears ad enhance collections, including a new amnesty programme in respect of real property taxes that incentivizes increased payments. There are four components to this programme designed to encourage self-registration, encourage registered property owners with arrears to become current with their tax payments and reward residential property tax payers who are current with their assessments.

To make Real Property Tax more client-focused, we have introduced a process to automatically review all instances of year-on-year variations in residential property tax assessments of more than 15 percent or where the average yearly increase between revaluations exceeds 10 percent.

As part of revenue reform, we also announced a new schedule of fees for various Government services that better reflect the costs to Government of providing those services to citizens and businesses.

As for actions to enhance revenues, our efforts are multi-faceted and include:

– Implementation of a broad programme of tax reform as of next July including the introduction of a new VAT, the significant reduction in Customs duties and excise taxes and the elimination of the Hotel Occupancy Tax, with a net increase in the revenue yield of 2.2 per cent of GDP;

– Modernization of the real property tax system, including the acquisition of new, modern GIS-based technologies, such that it generates a doubling of revenues over the medium-term, equivalent to 1 per cent of GDP;

– Reforming the operations of the Customs Department to bring them up to international best practice standards, featuring an improvement of the infrastructure of Customs electronic submissions, thereby strengthening revenue controls and reducing Customs personnel costs;

– Introduction of excise stamps for tobacco products to reduce revenue leakage; and

– Implementation of a new Central Revenue Administrtaion and a Revenue Court to improve the efficiency of revenue administration and secure revenue collections.

All in all, this revenue plan of action is expected to increase the revenue yield of our tax system by some 4 per cent of GDP and bring it more in line with the norm generally observed in the Caribbean, though still below it.

With the successful implementation of this medium-term plan, we will deliver on our commitment to Bahamians to bring order to the public finances by eliminating the deficit and puting the burden of Government Debt on a downward path. More importantly its level in 2016/17 will be significantly lower relative to what it would be in the face of failure on our part to implement our medium-term plan.

What would occur if we failed to act? Were the Government to simply ignore the fiscal problem that it faces, its levels of borrowings and Debt would go on unchecked and the burden of Debt would grow to very dangerous levels approaching 70% of GDP and beyond over time.

Worse still, the effects on confidence, on interest rates and on the growth of both our economy and jobs would be devastating. For guidance, one need only look back at the reaction of the international ratings agencies to fiscal developments in The Bahamas. In December of 2012, Moody’s announced a downgrade in our country’s credit rating along with a negative outlook. To underpin its Statement, Moody’s cited a significant deterioration of the Government’s balance sheet since 2007, which was exacerbated by a low revenue base, and a high and rising debt level. Such downgrades mean higher interest rates for all of us.

By taking decisive action now, the Government seeks to arrest and reverse the trend in our public finances, eliminate the GFS Deficit and get the burden of Government Debt back down to more desirable and sustainable levels.

It is for these reasons that fiscal reform is a core component of the Government‘s national development plan going forward. The key to successful and durable fiscal reform is to re-engineer Government such that it does things better.

On one hand, that means ensuring that its programmes and services are delivered in as efficient and effective a manner as possible.

On the other hand, it implies a revenue system that is administered not only efficiently but in a fashion that is as fair as possible such that the burden of taxation is appropriately borne by all segments of society.

VAT AS THE CENTERPIECE OF TAX REFORM

After carefully considering the range of new revenue options at its disposal, the Government decided that a sales tax, in the form of a Value Added Tax, is the most suitable option for The Bahamas to enhance the revenue yield of its tax system.

Income taxes have been ruled out on the grounds that, based on the international evidence, they are less conducive to stronger economic growth and job creation than a broad-based tax on consumption.

A VAT has been chosen over a simple sales tax since, again on the basis of international experience, its built-in system of checks and balances makes it less prone to fraud and evasion.

As part of a broader reform of our tax system, the VAT combined with lower import duties and excise taxes, will also lead to fairer taxation under which the segments of society that spend a large share of their incomes on services will now pay taxes on those services. Under our current system based primarily on Customs duties, those persons have had to pay no taxes whatsoever on the services that they buy while those who buy goods for the most part have had to bear the brunt of the tax burden.

I also want to stress that the Government is fully committed to mitigating the impact of VAT on the most needy in society, through the financial enhancement of its various social assistance programmes. This is a practice that has been adopted in other countries that have introduced a VAT and it is one that we believe is most appropriate in the Bahamian context.

In deciding to introduce a VAT in The Bahamas, the Government’s reasoning has been straightforward and clear.

This new tax will:

secure an adequate revenue base to support modern Government and allow us to realize our plan for national economic and social development;

establish a tax structure that promotes economic efficiency, stronger economic growth and more job creation;

and make our system of taxation more fair across all segments of society.

I want to stress that, throughout the implementation process, Ministry of Finance officials have been meeting with various stakeholders, civic groups and citizens to review the draft VAT legislation and to listen to concerns. In a number of instances, where appropriate and consistent with the intent of VAT, these useful exchanges have resulted in modifications to the proposed VAT law that will soon be tabled in Parliament.

I would also mention the very constructive dialogue that I have had with representatives of the Coalition for Responsible Taxation. As is widely known, the Coalition is desirous of commissioning additional in-depth analysis of the VAT option, along with other possible options for meeting the fiscal targets in our medium-term fiscal consolidation plan. Members should know that I have informed the Coalition that I acknowledge their concern and am amenable to hearing the results of their studies as we move forward. I agreed that the Ministry of Finance will provide Coalition researchers with whatever data and research material that they might require in order to complete their work in a reasonable and timely fashion.

I have also alerted the Coalition to the reality that it would be unacceptable to inordinately delay fundamental and necessary tax reform through this process.

THE ECONOMIC CONTEXT

Before I turn to a discussion of the mid-year fiscal results, I will very briefly review the current and prospective economic environment.

Global Economic Developments and Outlook

The near-term performance of, and prospects for, the world economy have been broadly in line with, if not stronger than, what had been expected at the time of the 2013/14 Budget. Indeed, in its January 2014 World Economic Outlook, the International Monetary Fund suggests that the tide may finally be rising, largely on account of ongoing and strengthening recovery in the advanced economies.

The IMF estimates that the world economy expanded by 3 per cent in 2013 and that growth will be slightly stronger than previously expected in 2014, at 3.7 per cent.

As for the U.S. economy, the IMF expects more buoyant domestic demand in 2014 as a result of the lessened fiscal drag flowing from the recent budget agreement. Growth in our most important trading partner is now forecast at just under 3 per cent this year, up from 1.9 per cent in 2013.

The IMF has also increased its short term forecast for the Euro area economy which, after having contracted by 0.4 per cent last year, is expected to expand by 1 per cent in 2014, though the recovery will continue to be uneven across its various member nations. The U.K. economy, in contrast, is seen to expand by 2.4 per cent in 2014, up from 1.7 per cent in 2013, on the basis of improved confidence and easier credit conditions.

Domestic Economic Developments and Outlook

On the basis of the latest reports from the Central Bank, there are clear indications that the Bahamian economy has continued to recover from the global crisis, on the basis of a slightly improved tourism performance and ongoing foreign investment projects. The Bank estimates that the growth momentum will be sustained through 2014 and beyond. This reflects increased room capacity and greater airlift combined with ongoing strengthening in a number of client markets. The construction sector is also expected to remain buoyant on the basis of brisk foreign investment activity.

This more positive economic situation and outlook is mirrored on the job front. In its latest Labour Force Survey, the Department of Statistics reported that the national unemployment rate declined significantly to 15.4 per cent in November 2013, down from 16.2 per cent in May. The particularly positive element of that report was that the fall in unemployment reflected an appreciable gain in employment, which was strong enough to absorb a concurrent increase in the labour force. The number of discouraged workers fell by 15 per cent over the six-month period. As well, the rate of unemployment declined in both the New Providence and Grand Bahama markets.

As for economic prospects going forward, the IMF concluded, at the end of its latest Article IV consultations last November, that the Bahamian economy is expected to expand more strongly this year and going forward. Growth this year and next is pegged at 2.3 per cent and 2.8 per cent, respectively. The Executive Board of the Fund reviewed the mission report on January 17, 2014 and endorsed its findings. In its concluding statement, the Board asserted that “steadfast and timely execution of needed reform will be crucial” to growth performance over the medium-term.

BUDGET PERFORMANCE IN 2013/14

Recurrent Revenue

The evolution of Recurrent Revenues in the first six months of the 2013/14 fiscal year has been relatively buoyant and largely on track. Through December, revenues have amounted to some $669 million, up by $36 million, or 5.7 per cent, from the comparable period in 2012/13. On the basis of this performance, we now expect full fiscal year Recurrent Revenues on the order of $1,480 million. That will represent 17.2 per cent of GDP, up from 16.7 per cent in 2012/13.

Recurrent Expenditure

As for Recurrent Expenditure, the data for the first six months of the 2013/14 fiscal year reveal that it totaled $841 million, representing 48 per cent of the full fiscal year estimate. That total is also essentially unchanged from the $839 million that was expended in the first half of 2012/13.

On the basis of this mid-year performance and ongoing spending control, we expect Recurrent Expenditure to be held to $1,720 million over the full 2013/14 fiscal year. That will be down slightly from the total of $1,737 that was forecast at the time of the Budget. This performance is in line with our stated objective of reducing Recurrent Expenditure relative to the size of the economy, as part of the fiscal consolidation plan. In the 2013/14 fiscal year, it will stand at 20 per cent of GDP; that will be down from the peak of 20.8 per cent registered in 2010/11.

Capital Expenditure

In the first six months of this fiscal year, Capital Expenditure amounted to $106 million, or 36 per cent of the estimate for the entire fiscal year presented in the 2013/14 Budget Communication. However, we expect a pick-up in this category of expenditure in the second half of this year, with total Capital Expenditure coming in on target at $295 million for the full year. That will still represent a substantial reduction relative to the size of the economy, from a high of 4.9 per cent in 2011/12 to 3.4 per cent this fiscal year.

Deficit and Debt

The GFS Deficit during the first half of this fiscal year amounted to $238 million, down from the $295 million recorded in 2012/13. On a full year basis, we expect the Deficit to come in on target, at $447 million, or 5.2 per cent of GDP. That will be down significantly from the 6.4 per cent of GDP registered in 2012/13.

Government Debt, at $5.1 billion at end-June 2014, is also expected to come in as forecast at the time of the last Budget. That will amount to 59.7 per cent of GDP.

REVENUE MEASURES

This mid-year fiscal statement contains a very small number of revenue measures, as follows: imports of point-of-sale equipment will be duty-free, to facilitate the adjustment of future VAT registrants to the introduction of the tax; sparkling wines and cognac are being moved from the Tariff Act to the Excise Act to secure revenues on these products; imports of vehicles for the use of the Government will be duty-free; and the Customs duty on imported eggs is being increased to 30 per cent to address the competitiveness of domestic producers.

CONCLUSION

Mr. Speaker, I have provided this Honourable House with a mid-year update on my Government’s ongoing prudent husbandry of the nation’s public finances. Through ongoing and steadfast adherence to our fiscal targets, we will succeed in eliminating the Deficit and returning the level of Government Debt to more prudent and sustainable levels over time.

As I did at last month’s Bahamas Business Outlook Conference, I have shared my great optimism for the future. We are on the right course. Resurging economic growth and a rebound in employment opportunities for Bahamians are the concrete proof. Our commitment to the path that we have charted will not waver.