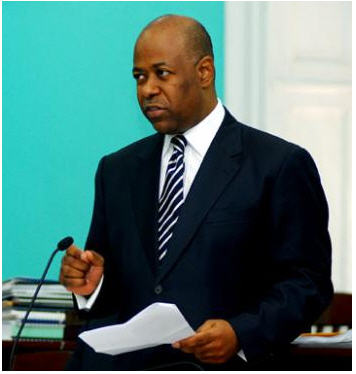

Nassau, Bahamas – The Hon. Obediah H. Wilchcombe, Minister of Tourism’s Communication on the Gaming Bill (1st Reading) in the House of Assembly on September 3rd, 2014:

Mr. Speaker,

I am pleased today to bring to Parliament a new cutting edge comprehensive Gaming Bill, Gaming Regulations and Gaming House Regulations, which are designed to more effectively control and revolutionize Gaming in The Bahamas for the greater benefit of the economy and people of our country.

In 1969, the Lotteries and Gaming Act (“the Act”) was passed by the Parliament of The Bahamas, and ushered in the licensing and regulation of casino gaming, under the authority of a gaming license. The Act has been amended sporadically since the coming into operation thereof in 1969, for the most part by the enactment of Regulations to make provision for additional procedures and requirements, as well as to expand the range of activities authorized by a gaming license to include sports betting and pari-mutuel wagering.

The most recent amendments to the Regulations were enacted in 2004, with the result that the Regulations themselves have not kept pace with changing operational requirements or technological advances. Collectively, this results in a somewhat piecemeal dispensation which has been broadened on an ad hoc basis and is now in need of a comprehensive overhaul, based on a clear policy direction.

Mr. Speaker,

The financial performance of the existing casinos has been severely affected by the global economic downturn, with revenue having declined across the board. The declining performance of the existing casinos in The Bahamas is also a function of the nature and content of the gaming dispensation for which the law currently makes provision, as well as the manner in which the industry is regulated, and the nation would be well served by the modernization thereof.

Numerous jurisdictions throughout the world have noted the dramatic expansion, in recent years, of the gaming offering, primarily as a result of technological advances, and have responded by reviewing and updating their gaming laws in order to remain globally attractive, to accommodate shifting consumer tastes in an increasingly discerning market, to stimulate tourist visitation and to generate revenues.

Mr. Speaker,

Against the backdrop of the above, specific proposals have been made by licensed industry stakeholders in The Bahamas regarding the measures that may be taken in advancing the attainment of the above objectives. These include:

(i) permitting non-continuous gaming floors with multiple cashier’s cages;

(ii) providing for the dual rating of employees;

(iii) permitting private gaming areas;

(iv) liberalising the credit dispensation;

(v) imposing entry levies for certain categories of permanent residents;

(vi) provisions for the enforcement of gaming debts;

(vii) tax-exemptions in respect of imported gaming equipment;

(viii) permitting licensed casinos to establish an online presence for the purposes of offering gaming;

(ix) permitting casinos or their gaming service providers to accept betting in-running (or live betting) on sporting events;

(x) authorising the establishment of independent testing laboratories in The Bahamas for the testing of gaming devices against defined standards;

(xi) providing for the licensing of junket agents within defined parameters;

(xii) provision for approval processes in relation to gaming equipment tested;

(xiii) the creation of technical specifications for mobile gaming devices/platforms and wireless gaming systems interfacing with communication devices operated exclusively by licensed casinos;

(xiv) provision for field trials in respect of gaming equipment which has been certified as complying with the applicable standard, pending approval thereof by the regulator;

(xv) provision for a three-yearly, as opposed to an annual, renewal process in respect of certain licences;

(xvi) the establishment of defined procedures for the management and resolution of patron disputes, and

(xvii) the adoption of measures regarding responsible gambling.

Mr. Speaker,

The Gaming Bill, 2014 and the proposed Regulations make provision for the adoption of a large majority of the above recommendations, in some cases subject to certain refinements. The primary objectives are to create a streamlined, user-friendly, efficient licensing and regulatory regime, overseen by a financially sustainable regulatory authority, which is responsive to the following critical objectives:

![]() Driving revenue, so as to increase the tax base and stimulate job growth;

Driving revenue, so as to increase the tax base and stimulate job growth;

![]() Creating a sustainable competitive advantage for the gaming sector in The Bahamas, and

Creating a sustainable competitive advantage for the gaming sector in The Bahamas, and

![]() Increasing Tourism, using the gaming industry as a springboard.

Increasing Tourism, using the gaming industry as a springboard.

A number of provisions of the existing Lotteries and Gaming Act and the various Regulations deal with detailed operational procedures and processes which are not issues of legislative policy and are therefore more appropriately contained in Rules to be made by the Board or the Internal Control Standards of license holders.

The Gaming Bill sets forth the key issues of policy in terms of which the various sectors of the gaming industry in The Bahamas will be licensed and regulated, while the proposed Regulations put in place the primary procedures and mechanisms by means of which these policy objectives are to be attained. Separate Rules have been drafted for adoption by the Board, which set forth certain detailed requirements with which license holders must comply in key areas of their licensed operations on a day-to-day basis. The internal procedures to be adhered to by license holders in order to ensure compliance with the Act, the Regulations and the Rules, will be contained in Internal Control Standards to be submitted to the Board for approval. The Gaming Bill and the proposed Regulations and the proposed Rules respectively provide detailed guidance regarding the minimum standards with which such Internal Control Standards will be required comply.

Mr. Speaker,

The current legislative and regulatory dispensation does not make provision for the streamlined and focused licensing and regulation of the industry by a financially self-sufficient Board. The human resources of the Board are not effectively applied to ensure that the regulation of the industry is based on identifiable risks in the gaming environment. The performance of the regulatory functions of the Board is to a large degree focused on being physically represented in licensed casinos to monitor and verify activities which are under constant surveillance and which can be audited on an ex post facto basis. This is largely a function of the fact that the current legislation dates back to a time where physical monitoring and regulation was appropriate, given the absence, at that stage, of the technological controls which are now common in the gaming environment. Resources are also unduly taken up by the annual repetition of probity investigations in relation to persons employed in the gaming environment.

As a result, it is important that the focus should be shifted to risk-based regulation. In addition, it is important that the Board itself should be properly equipped to exercise its regulatory powers and functions in an effective manner. In order to achieve this, it is necessary to ensure that persons appointed to membership of the Board have a range of particular qualifications which, collectively viewed, will enable the Board to call upon a balanced set of skills in the exercise of its various decision-making functions. Accordingly, the four-member Board should include an appropriately qualified legal practitioner, a qualified accountant or auditor and such other members as have knowledge or experience in other areas which are germane to the functioning of the Board. This will enable the Board to perform the various functions assigned to it, including the evaluation of applications, the conduct of investigations and hearings, the making and enforcement of Rules and its compliance monitoring of licensed operations, from a position of strength.

In addition, the Board should ideally be a financially sustainable entity in its own right, rather than being subsidised by the Government. In accordance with international best practice, licences and other approvals for the conduct of gaming should be regarded as valuable concessions granted by the Government, in consideration for which fees are due. The investigation costs incurred by the Board, as well as the annual costs of compliance monitoring, should be funded by the industry. For this purpose, provision has been made for various categories of licence, as well as certificates of suitability, all of which are annually renewable and subject to such conditions as may be imposed and all of which attract fees on an ongoing basis. It should be noted, however, that the Board will be required to incur certain further costs in the context of information technology infrastructure and resources, training, consultancy services and related matters.

Mr. Speaker,

The structure of the legislation is a further aspect of which note should be taken. As previously noted, the core policy issues regarding the licensing and regulation of the industry are captured in the Gaming Bill, while the primary procedures and mechanisms required to achieve the policy objectives are set forth in the Regulations. In the context of the detailed procedures and processes which form part of the day-to-day operations of the industry, however, the Board is vested with the power to make Rules, subject only to the concurrence of the Minister responsible for the administration of the Gaming Act (“the Minister”), which are not required to be assented to by Parliament for their enactment or amendment. This enables the day-to-day operation of the industry to keep pace with rapidly developing technological advancements, so that it is able to remain vibrant, current and competitive.

In addition to the above, in accordance with prevailing international standards of best practice, licence holders are required to submit internal control standards to the Board for approval. Internal control standards proceed from the objective of ensuring to the greatest degree possible, the proper, efficient and compliant conduct of licensed gaming operations. In the context of a licensed casino, for example, an ICS is developed by collating all the legislative and regulatory requirements which apply to the casino industry, including the Act, the Regulations and the Rules, as well as the provisions of other legislation applicable to its operations, such as the provisions of anti-money laundering and financial transaction reporting legislation, and then developing and describing the procedures which must be adhered to in order to ensure compliance with these requirements at all times and on all levels of the operation. Accordingly, the legislation, both primary and subordinate, describes what must be achieved and to a certain extent, minimum standards and procedures required to ensure the achievement thereof, while an ICS describes, at a far greater level of detail, the operational steps which licence holders will implement to ensure compliance.

Mr. Speaker,

In the context of licensing and the issue of certificates of suitability, the Board is vested with the power to grant, refuse, suspend and revoke employment licences, junket operator licences and supplier licences, and to impose, withdraw and amend conditions in respect thereof. It may also exercise similar powers in relation to applications for certificates of suitability, other than certificates of suitability to be granted in respect of gaming service providers. However, in the context of applications for gaming, proxy gaming, mobile gaming and licences and certificates of approval applied for by corporate entities, as well as the approvals required in respect of gaming service providers, the ultimate decision is vested with the Minister. The Gaming Bill makes provision for a mandatory approval process in relation to these applications, so as to ensure that administratively fair procedures will be followed in relation to all aspects of the approval process, including the imposition of conditions.

In the context of revenue generation, provision will be made in Regulations to be made in under the Act for the gaming taxes generated by licensed activities to be paid to the Board itself. Within seven days of the receipt of such taxes, the Board is obliged to pay same over into the Consolidated Fund. Penalties and interest may be imposed in respect of the underpayment of taxes due.

The proposed tax collection procedures enable the Board to monitor the proper calculation and payment of taxes on an ongoing basis, and to take immediate remedial action where these are not paid in the correct manner or quantum. The basic taxes payable in respect of casinos have remained unchanged, as have the tax rates (calculated on a sliding scale) in respect of gaming revenue on existing games. New licenses, taxes and fees are provided for with respect to restricted interactive gaming, proxy gaming and mobile gaming.

Mr. Speaker,

The financial implications of the proposed dispensation are positive, inasmuch as the legislative dispensation has been structured in such a manner as to provide the Board with an ongoing income stream designed to cover the costs of its licensing and regulatory functions. It is anticipated that the Board will begin to move towards a position of financial self-sufficiency as a result of this.

The Gaming Bill empowers the Minister to set the fees in respect of the various licenses, certificates and approvals contemplated therein by Regulation. This approach will allow for greater flexibility in the amendment of the fee and/or taxation structures in the future.

Mr. Speaker,

The modernisation of the gaming dispensation, and the new offerings which licence holders will be in a position to provide, as well as the provision of the Rule-making function of the Board, which will enable the industry to remain current in its offerings, are all expected significantly to enhance The Bahamas as an international gaming destination, resulting in a substantially enhanced revenue generation potential for the nation as a whole.

The new licence types created by the Gaming Bill are expected to translate into the creation of additional employment opportunities in The Bahamas, particularly in the area of communications and information technology.

Mr. Speaker,

In the drafting of the Gaming Bill, the proposed Regulations and the Draft Rules, account has been taken of other legislation having a bearing on the subject matter of the proposed legislation, including –

(a) The Constitution,

(b) The Criminal Procedure Code Act,

(c) The Financial Administration and Audit Act, 2010,

(d) The Financial Transactions Reporting Act, 2000,

(e) The Financial Transactions Reporting Regulations, 2000,

(f) The Financial Intelligence Unit Act, 2000,

(g) The Financial Intelligence (Transactions Reporting) Regulations, 2001 and

(h) The Proceeds of Crime Act, 2000.

Mr. Speaker,

As foreshadowed during the last Budget debate, my Government’s position on the regularization of web shop gaming has evolved as a result of certain realities which have emerged, following the outcome of the Referendum on this issue. These realities can no longer be ignored. The Governor of the Central Bank has drawn attention that web shops operators were acting as bankers and hiring bank employees for this purpose. Concern has been expressed with regard to the violations of the country’s international obligations, which could have severe consequences for The Bahamas vital financial services industry. After wide consultation and in order to preserve and protect the national interest, my Government has decided that the right thing to do in the circumstances is to regulate web shop gaming. We have heard the views and dialogued with the various groups who either support or are opposed to Gaming. We value, respect and understand their position. Nevertheless we are caught in a situation where the Government must govern and regulate.

Provisions has been made in the Gaming Bill and in the elaborate regulations thereunder, for a regularization process in relation to current web shop operators, as well as for appropriate transitional provisions, in conformity with international best practices and in full compliance with the prevailing anti-money laundering and counter terrorist financing requirements. Consultation led by the Attorney General has taken place with the Financial Action Task Force to ensure that the provisions of the proposed legislation and procedures will be in compliance with FATF guidelines so as to ensure acceptance by banks of proceeds from legalized and regulated casinos and web shop operators. In this regard, consultation continues with clearing banks operating in The Bahamas.

The objective of this exercise is not to foster the proliferation of gaming among Bahamians but to control and regulate it. There will be a fixed number of web shop operator licenses as well as web shop premises. Licenses will be granted pursuant to detailed criteria to be set forth in an RFP, containing appropriate minimum criteria for the licensing of web shops, on the basis of which the application and licensing process will be managed.

The Gaming Bill and Regulations will provide for applicable features of a successful, responsible gaming strategy including public education, protection and treatment of gambling addicts. It is envisaged that through a public-private sector initiative a Foundation with a Board of Directors, with an independent Chairperson, will be set up to administer the programme to be funded by the gaming industry. The public awareness and prevention component of the programme would be focused on taking proactive measures to inform the public of the potential dangers of gaming, the nature of gaming addiction and the symptoms of problem gaming, with a view to preventing problems before they occur, rather than simply responding to these problems once they have arisen.

In addition to fees, taxes and penalties which will be applied to web shop gaming operators, provisions will also be made for contributions to charitable and social causes. Consultation continues to take place with casino and web shop operators and other relevant parties as the process moves forward.

Mr. Speaker,

The new law will provide for the issuance of a Gaming House Operator Licence to existing operators. In addition to the issuance of licences to Gaming House Operators, the new Gaming Bill will provide for the issuance of Gaming House Premises Licences and Gaming House Agent Licences.

Gaming House Operator Licence shall be issued only to a fully Bahamian-owned company and may only be applied for in response to a formal invitation to apply for such licence.

Gaming House Premises Licence provides for a separate gaming house premises licenses to be issued in respect of the dedicated premise. The Gaming Bill stipulates the nature of the gaming activities which may be conducted on such premises and again may only be applied for in response to the RFP.

Gaming House Agent Licence will cover the existing arrangements whereby third party agents of the current web shop operators accept cash betting on the numbers game on their business premises, pursuant to an agreement entered into with the web shop operator, and against payment of a commission and shall authorise the conduct on licenced premises—

(i) of cash betting transactions only;

(ii) on the numbers game only; and

(iii) with domestic players only.

The new Gaming Bill provides for supplier licenses which will be required by every person who distributes repairs, maintains, alters, modifies or otherwise directly supplies any gaming device, and may only be issued to a company.

Mr. Speaker,

Provision has also been made in the Gaming Bill for two additional categories of licenses, namely key employee licenses and gaming employee licenses. A key employee license is required by every person who may exercise direct control over gaming operations or activities authorized by the principal license, or such other person whom the Board may identify. These persons will include, managers, supervisors, pit bosses, etc. A gaming employee license is required by every person who is employed by the holder of the principal license and who is directly involved in activities performed under that license, but excludes key employees. Such persons would be, cashiers, dealers, security personnel, etc. These provisions represent a change from existing practices, under which such persons are subjected to probity investigations on an annual basis, but are “approved” by the Board.

The new legislation provides for the various forms of lottery. A new provision has been included in the Gaming Bill to empower the Minister to authorise the conduct of a National Lottery in The Bahamas, and to appoint a service provider to operate the national lottery under a management contract. The Gaming Bill further provides for the Minister to make regulations (inter alia) governing the management contract. The Gaming Bill also confirms the ongoing illegality of all other lotteries other than –

(a) any national lottery that may be implemented;

(b) charitable lotteries;

(c) private lotteries;

(d) lotteries which are incidental to certain entertainment events; and

(e) the numbers game, when offered by the holder of a gaming house operator licence.

Mr. Speaker,

The new legislation will also empower the Minister responsible for Gaming to make Regulations permitting participation in the types of gaming contemplated in casinos and gaming houses by any category or all categories of persons, which may regulate the circumstances under which and the conditions subject to which such participation shall be permitted.

Mr. Speaker,

I wish to express appreciation to the team of officials who have worked tirelessly on these new measures with their many complex issues, along with our gaming consultants AG Consulting of South Africa and Grant Thornton Accounting firm. These officials were drawn from the Office of the Prime Minister, the Office of the Attorney General, the Ministry of Finance, the Ministry of Tourism and the Gaming Board.

Mr. Speaker,

I am pleased to be able to introduce and lay on the table of Parliament the following:

· Gaming Bill, 2014,

· Gaming Regulations, 2014,

· Gaming House Operators Regulations, 2014,

· Financial Transactions Reporting (Amendment) Bill, 2014

· Financial Transactions (Gaming Exemptions) Regulations, 2014 and

· Proceeds of Crime (Amendment) Bill, 2014