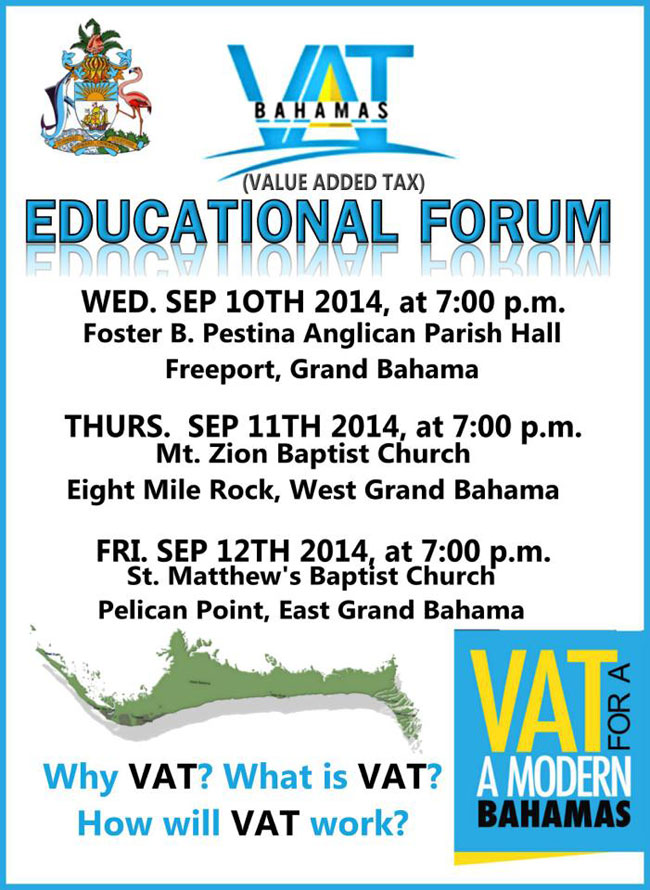

FS John Rolle delivers VAT education on Grand Bahama…

Freeport, Bahamas — In a presentation to the Grand Bahama Chamber of Commerce on September 10, the Financial Secretary stated that sales of goods between licensees of the Grand Bahama Port Authority would be subject to VAT and that VAT would only be excluded based on the amounts that should have been collected by Customs.

“I want to clarify that this is not the case,” he said. “The intended treatment of these transactions is exactly as they are described in the Guidance Notes for the Port Area and in the legislation. Sales of these items between licensees, where they are considered consumables, are not subject to VAT.”

The Financial Secretary went on to explain that “what the law does provide is for licensees to apply for a refund of VAT already paid to Customs in cases where licensees are supplied with goods shipped from elsewhere in The Bahamas. This is because local suppliers who operate outside the Port Area would not be required to distinguish amongst the final VAT treatment that is afforded to end customers within The Bahamas. They would charge the VAT whenever the law required such. As a consequence, and in such circumstances, Port licensees would have to seek direct refunds from the government.”

Under the VAT legislation, Port licensees are not required to pay VAT on goods that are imported into Freeport, where these go directly into producing other goods or services. The legislation treats these as “non-consumables” within the meaning established by the Hawksbill Creek agreement.

The Financial Secretary also stated that “how licensees are treated in these cases does not materially weaken Grand Bahama’s revenue potential. It does however reduce the amount of VAT credits that would be claimed by licensees that are VAT registrants.”

10 September 2014