VAT PSA 15 from King Of Hearts Media on Vimeo.

FREEPORT, Grand Bahama – Assistant Controller of Customs Sherrick Martin on Tuesday announced a number of new initiatives The Department of Customs has undertaken, during a press conference at the C.A. Smith Building.

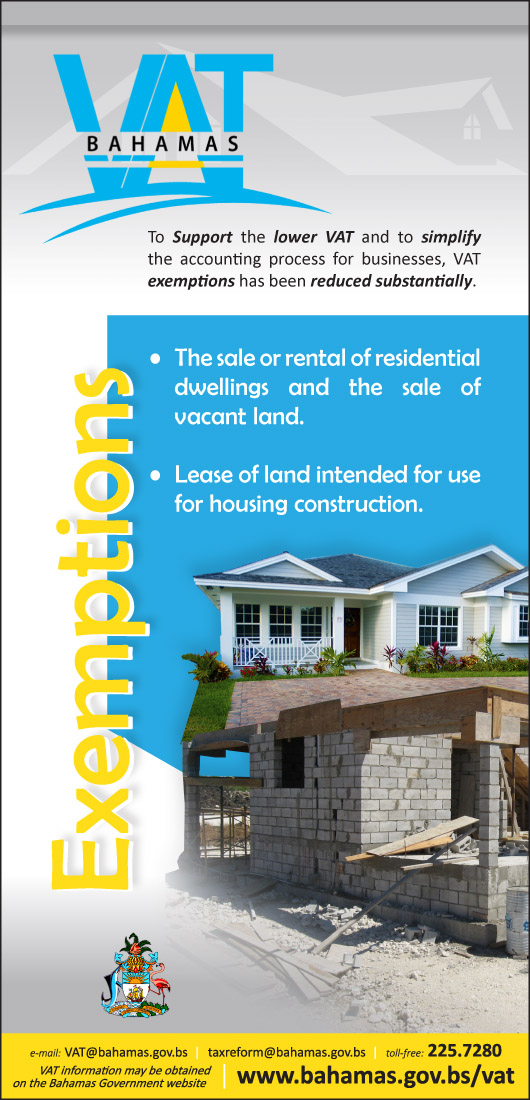

The introduction of Value Added Tax (VAT), Electronic Data Interchange (EDI), and Excise Stamp Control (amendment) Act with respect to tobacco products are among the changes the Department has been preparing for.

In preparation for the introduction of VAT, Mr. Martin said they have met with the VAT Department, Customs Brokers, shipping agents and couriers.

“VAT, as we know it, is a broad-based tax on goods and services where the country is involved for the common good. We can tell you we are ready for this new initiative and I believe that its revolutionary and a paradigm shift from the way we used to do business and will also enhance productivity within our organization.”

To assist the public with this, he said, officers worked extended hours on Christmas Eve, and will do so again on Wednesday, December 31st, because items left in the warehouse after that date are subject to VAT.

Mr. Martin also announced the reduction in duty on some products: stoves reduced to 5%; handbags, duty free; jewelry, duty free; aluminum doors, 5%; energy efficient refrigerators, 5%; cameras, free; and watches are now free.

According to Marsha Lebronson-Stubbs, chief customs officer, “the EDI, which is the Electronic Data Interchange, is the outside element where the public can now do their entries to Customs and submit it to us electronically. Customs is now going towards where we will be totally paperless.”

The entire process, she added, will now be done in 24 hours or less. “The whole gamut of EDI is to facilitate trade in a very fast way.”

Addressing the new tobacco products Excise Stamp Control (amendment) Act, 2014, Superintendent Leonard Johnson said the initiative is new, and any tobacco product found in a store without an excise stamp affixed will be subject to seizure.

“If you go into a store and buy a cigar or cigarettes and the stamp is not on it, it is not a legal product. The Compliance Unit is doing periodic checks, and quite a few tobacco products were not in compliance. Whether you import your products or have them made locally, it must have the stamp affixed. You must apply to the Ministry of Finance and the stamps will be issued.

“In the event that we visit your place and there are no stamps there — they become subject to seizure, so I’m sure you are going to see quite a bit of tobacco products off the street.”

Adding to this, Mr. Martin said any person who engages in the sale or manufacturing of tobacco products, must be registered with the Secretary of Revenue in the Ministry of Finance. He warned, “The fines, if we were to check your goods or to check your stores and find that the stamps are not affixed to the cigarettes or cigars, and if you are not registered the fine is extensive. It ranges from $20,000 to $100,000 and a maximum of five years in prison, or both.

“It is a wise thing that all those persons who engage in the sale or the importation of tobacco products, to ensure that their cigarettes are properly stamped. When they would have registered with the Secretary of Revenue in Nassau, they will also apply for the stamps. The stamps will be forwarded to the Customs Department in Nassau and they will be forwarded to Freeport where they will be issued by the Excise Officer in the Customs Department for the sole use of that importer.”

According to Supt. Bodie, “we are expected to implement VAT as of January 1, 2015. The Customs Department is mandated, having regard to the provisions of the VAT Act, to collect VAT at the borders.”

The standard rate of tax, he said, will be 7.5%. In January, there will be a few changes however. “At present when the passenger comes in, they declare his or her value which is essentially the dutiable value. Come January 1, essentially there will be two values they ought to be concerned with. Dutiable value and the VAT-able value.”

Explaining this, he said, if a passenger comes in and imports $300 worth of goods, the normal exemption will still be in place. Each passenger still has two exemptions of up to $300. The passenger will get their exemption and there is no VAT. If however, the passenger imports a microwave in that $300 worth of goods, the microwave is subject to a levy of $5. The exemption will be on the duty, but not the levy.

Giving another example, he said, if a passenger imports $100 worth of duty free goods, right now they will pay nothing. After January 1, these items will be VAT-able at $7.50.

“It is very important to bear in mind that essentially two values now: Customs Duty value and also the VAT value.”

VAT PSA 14 from King Of Hearts Media on Vimeo.

PSA 18 from King Of Hearts Media on Vimeo.