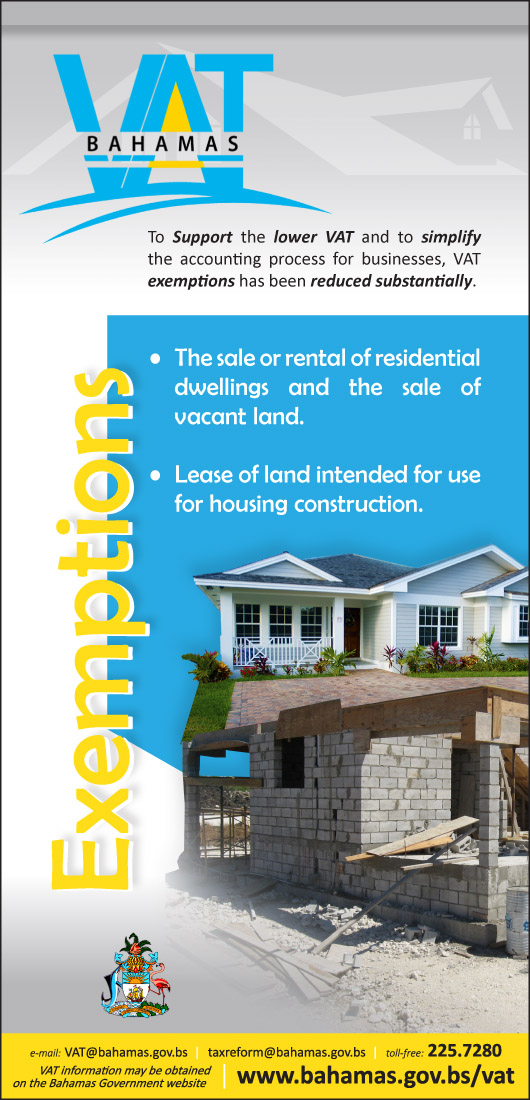

The Ministry of Finance’s Value Added Tax (VAT) Department wishes to advise any person conducting events for the purposes of public entertainment to send a list of scheduled events to the department as soon as possible.

The Ministry of Finance’s Value Added Tax (VAT) Department wishes to advise any person conducting events for the purposes of public entertainment to send a list of scheduled events to the department as soon as possible.

The list can be emailed to vat@bahamas.gov.bs

Events which will generate income from ticket sales and other revenue related activities must be registered with the department by applying to the VAT Comptroller before the event is advertised.

Public entertainment activities include sporting events, cultural events, concerts, dinner parties and balls. A promoter includes non-profit organizations, religious organizations and charities.

Applicants must complete the normal registration form but first submit Form 33 – “Notice of a Public Entertainment Event” at least 48 hours before the event is advertised in accordance with Section 19 (3) of the VAT Act. A bond is also required to secure the anticipated VAT liability.

VAT Returns should be filed seven calendar days following the completion of the activity.

For more information visit the government website at www.bahamas.gov.bs/VAT or call VAT Client Services at 1-(242)-225-7280

February 17th, 2015