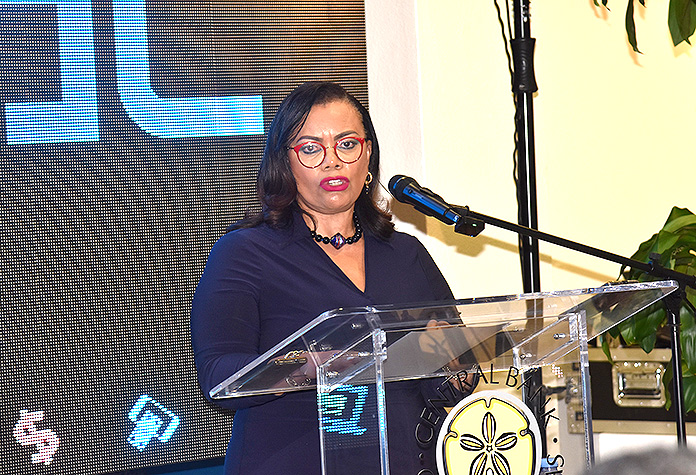

NASSAU, The Bahamas — The Chair of the Clearing Bank Association, Denise Turnquest said the Association and The Central Bank of The Bahamas have agreed to create an educational campaign to prepare consumers and businesses to become more comfortable with digital banking.

“What we have determined is that whilst the world is increasingly using digital banking, there are some among us who are resisting embracing it, and who have concerns – usually those concerns are around elderly family members or elderly persons who are not tech savvy within our communities,” Ms. Turnquest said at the Live Digital Campaign Launch held at The Central Bank of The Bahamas on Monday, May 27, 2024.

The campaign branded as ‘Live Fast, Pay Digital’ is aimed at promoting what is called ‘faster, safer, greener’ ways to pay and get paid, including the expanded use of digital platforms.

The Clearing Banks Association is composed of the following domestic commercial banks: The Bank of The Bahamas, CIBC Caribbean, Citibank, Commonwealth Bank, Fidelity Bank & Trust, RBC Bahamas and Scotiabank Bahamas.

Ms. Turnquest explained that the banks have heavily invested millions of dollars in their digital banking capabilities with their objective being to deliver first-class products and services.

“We want to make sure that here in The Bahamas, we are keeping pace with the best that is available worldwide.”

She added that the Clearing Banks are also investing heavily in cyber security.

“We are investing not only in cyber security, but in testing the resilience of our cyber security individually and as a unit – meaning the banking system to ensure that all of our systems are safe from theft or damage, and by extension that the public’s money is safe.”

Ms. Turnquest explained that digital payment is any payment that does not involve paper or cash. This includes credit cards, debit cards, online banking, digital wallets, apple pay and other cell phone apps.

She said the main benefit of paying digitally is that it is faster; when customers pay online, they have access to their money right away. It is also safe and people are operating in a secure electronic environment.

“Therefore, you are avoiding things like pilferage. When you operate a cash business, you do not even know what you lose to your employees.

“We unfortunately live in a high crime environment and therefore there are huge investments required for security for cash intensive businesses.”

Mrs. Turnquest noted that The Central Bank, the Clearing Bank Association and the Bahamas Chamber of Commerce & Employers Confederation have partnered to ensure that the public and businesses are educated on the use of digital banking through a series of activities and messaging across a variety of platforms.

“This campaign will include radio shows, TV appearances, meetings, commercials, town hall meetings and a tech expo planned for later this year where you will all be invited to come and learn firsthand from tech providers and digital banking providers on how to use their systems.”

She also noted that the banks are also investing heavily in ATMS and the ability for people to get access to cash without having to see a teller. “So, you can rest assured that we will leave no one behind.

“I think there is a commitment from all of our parties: The Central Bank, the Clearing Banks Association and the Chamber of Commerce. We will do all that we can within our power to allay any concerns you may have today and ensure that everyone is able to get on the digital journey in a well-educated and supported way.”