REMARKS BY

HON. L. RYAN PINDER

MEMBER OF PARLIAMENT FOR ELIZABETH

2015 / 2016 BUDGET COMMUNICATION

June 10, 2015

Introduction

Mr. Speaker,

On behalf of the people of the great constituency of Elizabeth I rise to offer my full support to the 2015-2016 Budget. As has been a staple of this PLP administration, the budget is a forward looking, progressive, and realistic statement of the Government of The Bahamas’ intent for betterment of the people of The Bahamas. Consistent with the fiscal policy from when we took office in 2012, this Budget balances the necessary and responsible policy of sound fiscal governance with a framework and innovative strategy for the advancement of Bahamians, providing the basis for employment, career growth, and entrepreneurship of the Bahamian people.

I represent an economically diverse constituency. However, while the economic realities of the people of Elizabeth may run the full spectrum of possibilities, we all want a better future and an opportunity to participate fully in the economy of our country, we all want to have hope and options for a better life. This budget and the activities and programmes which it will fund provide many with that opportunity. This is a Budget that moves to secure the future for all Bahamians and establishes the strategy for economic expansion for all Bahamians.

Budget

Mr. Speaker,

Fiscal Prudence – I would like to address certain matters specifically related to the content of the Budget and the Budget Communication by the Right Honourable Member for Centerville. Detailed in this budget are the results of prudent fiscal management that was announced two budget cycles ago by the Right Honourable Member for Centerville. At the time, when the medium term fiscal management plan was detailed, the Opposition said that it couldn’t be done, that the projections were unrealistic guesses. Well we sit here today and look at the results of fiscal responsibility, we look at the results of a fiscal management plan that did work, we look at results that indicate the out of control spending and borrowing of the prior administration has been arrested and is to be reversed where the debt to GDP ratio is projected to decrease in the forthcoming years. This is a remarkable feat from where we were when we took office, and I want to congratulate the Prime Minster, and the Minister of State Finance and their team in doing just what they said they would do, ensure that the financial future of this great country was secure.

As announced by the Prime Minister, the ongoing rise of the Government Debt burden will be arrested and the ratio will decline in the 2015/16 fiscal year; it will then fall steadily to reach 56.8 per cent of GDP in 2017/18, down from the peak of 61.1 per cent in 2014/15. This is a tremendous achievement by this administration, and achievement that ensures a path to long term fiscal sustainability, something our peers in the region can only be envious of. I do want to point out to the Bahamian people that this is a conservative estimate based upon revenue generation to pay down debt, and the proper fiscal management of the economy and government expenditure. It is important to note that as the growth strategy of the Government of the Bahamas is realized, the GDP by definition will grow, and the debt to GDP ratio by definition will decline at a faster rate.

With respect to VAT and the use of the proceeds, the budget would indicate that this Government is and has committed to using the proceeds for exactly what it said it would, the reduction of the debt obligations of the Bahamas. If one were to look at the gross borrowings on a year to year basis that are reflected in the budget, you would see that proceeds from borrowings were at a high of $615.8 million in fiscal year 2013/2014 and year by year have decreased, with a projection of only $170.6 million in fiscal year 2017/2018. This PLP Government should be commended on addressing the vexing issue of a spiraling deficit that was put in place by the former FNM Government and clearly has used fiscal reforms for their intended purpose, for the reduction in the deficit and the debt obligations of the Bahamas.

Youth Initiatives – Not only is this a budget that builds on the fiscal successes of this PLP Administration, it is a Budget that will provide opportunities for the advancement of Bahamians and the economic development of the Bahamas. This is a budget that secures the future for Bahamians, especially Bahamians who are most challenged, the youth of our country. I want to commend the Government on its inclusion of a $20 million allocation under the Ministry of Finance to address youth unemployment, in conjunction with the Urban Renewal Programme. In Elizabeth, like many other constituencies in the Bahamas today, youth unemployment is the single largest issue. The introduction of a well-managed, sustainable and hope filled program is fundamental to our youth, and ultimately to our country as a safe, optimistic and fruitful paradise. I trust this programme could be in conjunction with the promised Urban Renewal Center that has been announced for Elizabeth Estates.

I want to be clear, this is not a program that has any relation whatsoever to the much maligned FNM initiated 52 weeks job initiative programme which the Auditor General has found serious examples of a lack of transparency and proper governance.

· This youth program will not be used for election gain like the 52 week program.

· This youth programme will not be plagued with the findings of the auditor general that “internal controls for the operation of the 52 weeks programme were severely deficient”

· This programme will have proper internal governance and controls, unlike the 52 weeks programme where it was found that 45 persons were paid without requiring an employment contract

· This youth programme will have the necessary controls from the outside, unlike the 52 weeks programme from the outset of the programme there was the insufficiency and absence of key controls which created an environment highly vulnerable to the occurrence of fraud.

· This programme will be used as a platform for the further development and training of our youth, to provide a transparent programme focused on sustainable employment and skill development, unlike the 52 weeks programme where it was found that the Ministry of Finance did not undertake any performance reviews, nor did they establish a skill databank and unemployment register which were all segments of the 52 weeks programme.

The youth programme of this PLP Government will be a model of success and governance, unlike the failed, and high risk for corruption 52 weeks programme of the former FNM Government. Certainly if there is a program of abuse that the Public Accounts Committee should be focusing on it is the 52 weeks programme of the former FNM government, a program where $48 million was highly vulnerable to fraud, not an investigation of $117,000.

Skills Training – A frequent critique of the unemployed in the Bahamas, whether perceived or reality, and whether from local businesses or international investors, is the level of training and skills of our people. A responsible government assesses these issues and initiatives solutions to better prepare our people for employment and the ability to have a future. This Government in this term recognizing this initiated the National Training Agency to ensure that certain baseline skills were taught and engrained in your youth. This is a tremendous initiative and achievement and something that will affect generations to come. In the current budget we have further expanded the training and education of our youth to prepare them for the job market, and ensure that they are prepared for careers. The operations of the College of the Bahamas has seen a 24.5% increase in its budget allocation. The Bahamas Technical and Vocational Institute has seen a 41% increase in this year’s budget allocation. In fact, I am advised that the enrollment in BTVI has increased 35% since the PLP became government. The allocation for COB scholarships has been increased by more than 23% in this year’s budget. All of this investment in training and education is separate and apart from this Government’s investment in training by way of BAMSI. We have recognized that our youth require skills training, vocational training and education in order to be able to take advantage of the economic growth and innovation that this PLP Government is implementing. We are committed through all of our initiatives in the development of our youth, to combat the vexing issue of youth unemployment and sustainable training.

Growth Initiatives – I referenced economic growth initiatives in my discussion of the reduction of the debt to GDP ratio of the Bahamas. These growth initiatives will also allow for economic opportunities to be extended to my constituents in Elizabeth, helping to arrest the vexing problem of unemployment, especially among the youth. An element of economic growth and progress is the streamlining of business and investments, an area much critiqued as an impediment to economic development. I want to commend the Government of the Bahamas in establishing initiatives to streamline business in the country. Central to this is the establishment of long-term plan for national development. This will establish the road map for the economic progress of the Bahamas. Likewise modernization of key business infrastructure such as the customs modernization program to facilitate trade, and the streamlining of tax initiatives of the country to establish predictability are fundamental to economic growth. I want to encourage the Government to expedite the establishment of the Central Revenue Administration and to have it effect and centralize all tax collection in the country, a one stop shop for tax compliance. This not only creates efficiency and predictability but also causes for the proper and effective collection of tax revenues.

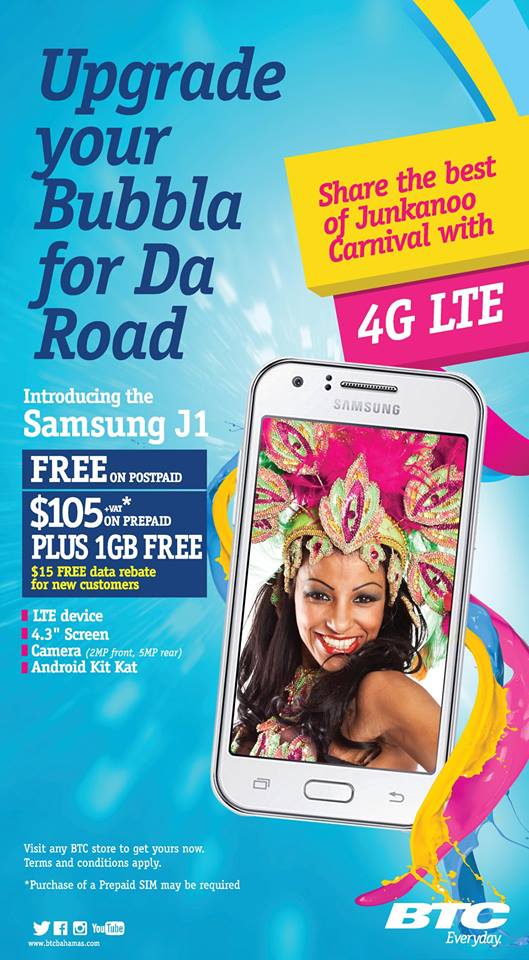

Mr. Speaker, we frequently hear that the economic model is not conducive to the youth of the country, that their talents are not given an economic platform to thrive. The Right Honourable Member for Centerville has championed the economic impact of the creative and cultural industries for our people. This is evident by the success of Junkanoo Carnival and I encourage my friend, the Member for Carmichael, to further development the economic exposure of our people in other areas of the creative industries, such as arts, music, key craft products such as innovative straw designs. These are important elements of the economic opportunity for the youth of our country, for the youth who have exceptional and varied talents and are in dire need for a platform to monetize these skills.

We have heard the Right Honourable Member for Centerville detail the varied commitments and development projects that are underway. This certainly gives a sense of hope, and confidence in our people that there are economic opportunities, there is economic growth, and that opportunities will present themselves to our young Bahamians.

Mr. Speaker, these are specific instances of legislative and policy initiatives by this PLP Government that will have direct influence on economic growth, growth that is focused on opportunities and the advancement of Bahamians and Bahamian businesses. The policy of this Budget is clear, responsible fiscal governance and strategic and deliberate initiatives to cause for economic growth and opportunity for Bahamians.

Lowering Cost of Living – A significant aspect of this budget is garnering little discussion. Certainly the implementation of National Health Insurance will have a tremendous positive effect on the lives of Bahamians who most need it. There are other notable initiatives in this budget that provide relief for Bahamians that allow them the opportunity to lower their cost of living, and provide a boost to economic advancement. The lowering of excise tax on vehicles is a significant advancement. Second to a home, and in certain instances a car is a Bahamian’s single largest purchase. To allow for better quality cars to be available at a 65% excise rate is a significant reduction for many Bahamians. Allowing taxi drivers to now import vehicles up to 3 years old, which in many instances are like new vehicles, is an excellent initiative to modernize our taxi cab industry and allow those beacons of entrepreneurism in the Bahamas have an ability to better invest in their business.

The restructuring of stamp tax and VAT on property purchases is a tremendous policy decision to encourage and facilitate home ownership amoung that segment of our population who are almost always foreclosed from the opportunity to what is regarded as the most significant wealth development initiative of a person during their lifetime, the ownership of their home. The Government proposes to reduce stamp tax on homes to 2.5% and apply VAT at 7.5%, however VAT will not apply to homes valued up to $100,000. This is a tremendous policy initiative of this PLP Government to facilitate home acquisition. Stamp tax and tax on transfers is a barrier to many to home ownership. I comment the Government on this initiative. I do have one specific recommendation to this program. Homes in Elizabeth Estates, a tremendously successful Government housing community, are selling between $110,000 and generally $150,000. I would ask the Government to extend the ceiling for only applying 2.5% stamp tax to property purchases to properties valued up to $150,000. This would allow my constituents of Elizabeth to have the opportunity of home ownership in one of the most successful Government housing neighborhoods in the Bahamas. The financial impact to the Government would be minimal; the empowerment of Bahamians, and Bahamians of Elizabeth would be monumental. I ask the Government to please consider raising the ceiling for the preferential rate on home purchases.

Philanthropy – I want to commend the Prime Minister and the Government to their commitment to philanthropy with increases in Government grants and subventions. Philanthropy and the support of NGOs by Government is very important, and in fact fundamental to the survivability of these institutions. I want to personal commend the Government for its increase in subvention to the Bahamas Humane Society from $15,000 to $50,000. The Bahamas Humane Society has undergone significant financial stress this past year due to its response to the canine distemper virus that has spread through our country. Again, on behalf of philanthropies the country over, and specifically on behalf of the Bahamas Humane Society of which I sit on the Board of Directors, I thank tis Government for their sensitivity an generosity.

Stronger Bahamas

There has been much miss-communication on the Stronger Bahamas initiative launched by the Government of the Bahamas, even from some on this side who cannot seem to look beyond his own mischievousness. Stronger Bahamas is neither political, nor is it as some would want to term it, an “election ploy”. Stronger Bahamas is non-partisan. No matter your politics, religion, island of resident, age or gender, Stronger Bahamas promotes unity and encourages all Bahamians to work together towards building a safe, prosperous, modern future. This initiative provides Bahamians with a vehicle to communicate directly to Government – through social media, through the website, and through in-person discussion groups. All feedback received will be used to help our shape our National Development Plan. This level of transparency and consultation with the general Bahamian public should not be questioned, but should be commended. This is revolutionary in the democratic process of the Caribbean. This Government should be congratulated.

I have just returned from being a guest speaker and panelist representing the Bahamas at Wilton Park’s meeting on the ‘Caribbean 2030: New thinking for a new generation’, which was held at Wiston House, West Sussex in the UK. This was a tremendous opportunity where new generation representatives from Government, private sector and NGOs came together to speak to the way forward for the Caribbean region. One of the primary complaints of the young business people was the lack of access to their government representatives, and a lack of ability to provide input in the development of their countries. Once again, the Bahamas is a trailblazer in the region, creating Stronger Bahamas as a platform for input, communication and consultation with the people of the Bahamas on the development of their country, addressing one of the key complaints and requests from the young leaders of the region. Congratulations to the Prime Minister and the Government of the Bahamas for such a revolutionary platform of citizenry consultation in governance and the way forward. I support a stronger Bahamas.

Financial Services

Mr. Speaker,

I now turn to the matter of Financial Services, the foundation of the middle class in this country, an area where I practice in before and after I was the Minister for Financial Services. I want to commend the Government and the Minister of Financial Services for the commitment to new product development and new market penetration, this is fundamental to our success as a jurisdiction.

China Renminbi Trading Platform – A key area of growth and diversification of our financial services industry lies in the recognition of the Bahamas as a jurisdiction for the trade and settlement in renminbi, the Chinese currency. This has the opportunity to cause for widespread development and growth in financial services, not only in areas we are familiar with such as private wealth management, but new areas of commerce, such as trade financing, and international commercial banking. In order for these opportunities to come to fruition here in the Bahamas, I encourage the Government to implement the trading platform in without unnecessary delay. These opportunities will not sit idly by, new opportunities will develop for and in other jurisdictions. As an example, since the award Chile has been granted status to trade and settle renminbi. It is also anticipated that China will launch by the end of this year a pilot program that called the China International Payments System (CIPS). This program is a planned alternative payments system to SWIFT which would provide a network that enables financial institutions worldwide to send and receive information about financial transactions in a secure, standardized and reliable environment. It would facilitate the settlement of renminbi cross border. A qualified bank can be a participant in CIPS, non-qualified banks can open an account with a qualified bank. Once CIPS is established in a comprehensive environment, the advantage as a designated hub for settlement and trading in renminbi will likely be diminished. It is very important that we launch and develop this platform as a currency trading hub in the shortest amount of time to gain a first mover advantage in this hemisphere.

In order to facilitate the trading platform, the initial step would be for the Central Bank of the Bahamas at the working group level to extend correspondence to the People’s Bank of China to express an interest in developing the Bahamas as a renminbi clearing a settlement jurisdiction and to have the permission for a Chinese bank to be present in the Bahamas. There would be a regulatory approval process between the regulators and then the Chinese bank would have to seek both CBIC and Central Bank of the Bahamas approvals for operating. This would also include a negotiated Memorandum of Understanding between The Bahamas and China.

The opportunities for the Bahamas are real and forthcoming. As an example, there are the regional initiatives of Chinamex. Chinamex is an overseas promotional department of China’s Ministry of Commerce and responsible for the development of DragonMart in Dubai, UAE. DragonMart provides a gateway for the supply of Chinese products in the Middle Eastern and North African Markets, offering Chinese traders and manufacturers a unique platform from which to cater to the needs of this sizeable market. Chinamex is developing a trading platform in Panama, modeled after DragonMart, which will offer Chinese traders and manufactures access to the Latin American market. The Bahamas has the opportunity to be the clearing center and banking center to more than 3,000 Chinese businesses that will be in Panama in this trade center. The total transaction volume anticipated in the Panama trade center is in excess of 10 billion dollars per year. These services would naturally include currency conversion transactions as the Bahamas will be an authorized jurisdiction for trading in Renminbi, as well as the 3rd party payment transactions in the Panama trade center. This also allows for the opportunity to manage the wealth of the Chinese entrepreneurs now in the region.

New Markets

China with SmartFund Model 8 – I was pleased to hear the Minister of Financial Services speak to a new fund product for the Chinese market in particular. This will be a tremendous advancement to opening up the Chinese market, a market that has been historically challenged for the Bahamas given its complexity and geographic location differences between our two countries. With the further exposure of the Bahamas in China, and eventually to Chinese tourists and business people through initiatives such as BahaMar and the Dragonmart concept in Panama, the opportunity is now to develop the Chinese market into a viable financial services market. A new geographic specific fund product, similar to the SmartFund 7 and Investment Condominium developed for the Brazil market, is fundamental. I encourage the Government to try to bring this fund product into law through its rule making powers as soon as possible to allow the private sector ample opportunity to develop and promote it in anticipation of upcoming promotional and trade trips to China.

Columbia Tax Information Exchange Agreement – We have successfully developed certain Latin American markets for financial services. Our greatest success has been in the Brazilian market, which the industry now seeks to duplicate in Mexico with the forthcoming BFSB Mexico Landfall later this month. In many instances, the ideal scenario for our growth in financial services, and particularly in Latin American countries, is after there has been sustained economic growth in that country and the economic and social atmosphere begins to plateau, creating some anxiety in the citizenry. In these circumstances the citizens seek diversification and stability by allocating some of their wealth internationally. The industry is seeing this development in potentially 2 new geographic markets, Columbia and Chile. The industry, through the BFSB, would like to enter and develop the Columbian market, however, in order to effectively do so there is a need for a Tax Information Agreement, due to the penalty withholding taxes that would otherwise be present. In order to create an environment for the private sector to develop the financial services market to Columbian citizens, I encourage the Government to review and analyze the applicability of entering into a Tax Information Agreement with Columbia.

Entrepreneurial Policies

I want to recognize the Government of the Bahamas and its philosophy of Bahamian entrepreneurism in financial services. Under this PLP Government and in accordance with its policy for Bahamians, the Central Bank of the Bahamas has reduced capital requirements for the establishment of Trust Companies from $1 million to $500,000. This shift in policy cannot be understated. In financial services, Bahamians have been trained and made careers for decades, we are now on our second and third generation of Bahamian trustees. Bahamian’s might have the most talented trustee professionals in the world, and now under the policies of this PLP Government Bahamians find it easier to be entrepreneurs in their profession. Today, new trust companies are largely Bahamian owned, and I am pleased the Central Bank of the Bahamas and this Government of the Bahamas have made this conscious decision to make it easier for Bahamians to be owners in the financial services industry.

Transparency Initiatives

I want to commend the Government of the Bahamas on its position with respect to FATCA and the OECD transparency initiatives. The Bahamas maintains a position of being compliant with international best practices, while taking a strong position in favour of the clients that utilize our jurisdiction, and differentiates itself in a progressive and innovative fashion as compared to our competitors. I congratulate the Minister of Financial Services for continuing to advance this position in the international arena and look forward to the Government’s commitment to being a global leader in the continued development of the global transparency initiative to put The Bahamas in the best position as possible.

Fisheries

I want to take just a little time to speak to the fisheries industry and the commitment that this PLP Government has made to maintain a sustainable fisheries industry. There hasn’t been a government in the history of the Bahamas who has committed more to the protection and advancement of the fisheries industry than this current Government. The Member for North Eleuthera just yesterday sought to create confusion when he raised vague and blanket questions as to our commitment. If he really cared about the issue, and if he were genuinely representing the interests of his fishing constituents, and especially those in Spanish Wells, he would have taken the time to review the budget and point out the monumental commitment of this Government.

I want to commend the Minister for National Security and the Prime Minister on their commitment to the fishing industry. From a review of the budget you would see that there has been an increase in the allocation for the Inagua Base Development from $2 million to $5.5 million. The Member for North Eleuthera if he truly understood the industry would recognize that boats are a necessity, yes, but the base in Inagua will be fundamental and a foundational element to the fight against poaching. This PLP Government in this budget has increased the allocation to complete the Inagua base by almost 300%. Likewise, the allocation for the up keep of sea craft for the Royal Bahamas Defense Force has seen a 450% increase in this budget, and the up keep of aircraft has seen an increase in its allocation of over 700%. The Minister for National Security made the point that the prior administration had no ocean going boats, had no bases, and never maintained the vessels they did have. This Government has taken a different approach, we put our money where our mouth is for the fishermen, through our focused development and constant commitment to national security, we are the Government that will finally arrest the poaching problem that plagues our fishermen. I shouldn’t expect anything different from the Member for North Eleuthera, he did vote against funding for the much needed Defense Force boats to protect the waters and the fishermen and their livelihoods.

Conclusion

This 2015 / 2016 budget is a budget of fiscal responsibility with a focus on growth and the development of our Bahamian people, and particularly the youth.