Commence Work Together to Increase Recoveries for Stakeholders – Securities Commission of the Bahamas Praised!!!

WILMINGTON, Del. and NASSAU, Bahamas,

Jan. 6, 2023

/PRNewswire/ — FTX

Trading Ltd. (d.b.a. FTX.com), and its affiliated debtors (together, the “FTX Debtors”), and FTX Digital Markets Ltd. (“FTX DM”), acting by the Joint Provisional Liquidators (Brian Simms, K.C., Peter Greaves and Kevin Cambridge), today announced their agreement on terms for mutual cooperation in the chapter 11 cases of the FTX Debtors in Delaware and the provisional liquidation of FTX DM in The Bahamas.

Under the cooperation agreement, the parties commence work together to share information, secure and return property to their estates, coordinate litigation against third parties and explore strategic alternatives for maximizing stakeholder recoveries.

The parties have agreed on parameters for involving FTX DM in the chapter 11 cases and for involving the FTX Debtors in proceedings in The Bahamas. The parties also agreed on the disposition of real estate in The Bahamas in a process operationally led by the JPLs and overseen by courts in both jurisdictions, as well as a process to confirm the inventory of digital assets under the control of the Securities Commission of The Bahamas in the Fireblocks account previously disclosed by the FTX Debtors. The parties are each comfortable the digital assets have been appropriately safeguarded by the Securities Commission as restructuring discussions continue.

“We would like to thank all of the Joint Provisional Liquidators of FTX DM for constructive meetings this week in Miami and all their work on behalf of their estate,” said John J. Ray III, the Chief Executive Officer and Chief Restructuring Officer of the FTX Debtors.

“There are some issues where we do not yet have a meeting of the minds, but we resolved many of the outstanding matters and have a path forward to resolve the rest.”

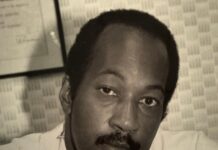

“Our meetings stressed our shared objective to find the best solution for customers and creditors of the FTX.com platform,” said Brian J. Simms, K.C. “Each jurisdiction has different tools available to accomplish that objective and we look forward to working collaboratively to optimize outcomes for all of our respective stakeholders.”

The agreement is subject to the approval of the U.S. Bankruptcy Court in Delaware and the Supreme Court of The Bahamas. The FTX Debtors will file the Agreement on the docket in the chapter 11 cases shortly, and it will be available at https://cases.ra.kroll.com/FTX/.

SOURCE FTX