Ginn Development proposal in West End Grand Bahama.

Nassau, Bahamas: Developers of Laurelmor, a 6,000-acre golf resort in Watauga and Wilkes counties, are trying to stave off foreclosure after missing principal and interest payments on a $675 million loan for Laurelmor and three other resort communities.

Development companies affiliated with Bobby Ginn are negotiating with Credit Suisse to restructure the loan. Lenders led by Credit Suisse agreed to delay their right to foreclose until next Thursday. The loans are with two Ginn-affiliated companies: Ginn-LA CS Borrower LLC and Ginn-LA Conduit Lender Inc.

The companies failed to make a June 30 payment and then entered into a 30-day forbearance agreement. Such an agreement allows a company to keep its property while working out a new payment plan.

Lubert-Adler, a real-estate private-equity firm based in Philadelphia that works in partnership with Ginn, has contributed $5 million in equity to use for operations, according to a report by Standard & Poor’s. The money will not be used for loan payments.

S&P recently lowered its credit ratings on the Ginn borrower company, as did Moody’s Investors Services.

Robert Gidel, the president of The Ginn Cos., said in a written statement that the $675 million involved Laurelmor, two communities in Florida and one in the Bahamas.

“Due to the ongoing slowdown in the residential real-estate market, it became clear that it would not be possible to meet the homesite sales objecti ves necessary to make payments due under the credit facility,” Gidel said. A credit facility is a type of loan.

ves necessary to make payments due under the credit facility,” Gidel said. A credit facility is a type of loan.

Gidel said that the company is negotiating with the Credit Suisse-led lenders and believes that it will be able to restructure the loan, which would permit each of the resort communities to be completed as planned.

Toby Tobin, a longtime Ginn watcher who runs GoToby.com, a real-estate news site based in Palm Coast, Fla., said that Ginn has a serious cash-flow problem and a short time to work things out.

“Ginn is facing two real problems,” Tobin said. “One is the cash-flow issue, and secondly, they have some lawsuits that have been filed and more in the works.”

Last year, a group of 99 investors from Michigan filed a lawsuit in federal court alleging that Ginn representatives tricked them into buying overpriced lots in some of Ginn’s Florida developments with the expectation that they could flip the lots at a substantial profit. The lawsuit says that Ginn created a complicated maze of companies in order to avoid scrutiny by the Securities and Exchange Commission, while perpetuating a Ponzi scheme, in which returns to investors were financed by newly recruited buyers.

Last month — just a few weeks before Ginn would fail to make its payment — rumors were swirling in the mountains that Laurelmor was getting ready to shut down.

Bobby Masters, an executive vice president for Ginn, said in a telephone interview June 12 that sales haven’t been as good as hoped at Laurelmor but that “we’re definitely not pulling the plug on it.”

Masters said that the developers had sold about 200 lots, and had built nearly 22 miles of roads and most of the water and sewer lines. They were preparing to start paving the roads and building a wastewater treatment plant, he said, and expected to have people moving into homes in 2009.

Masters said that there was no merit to the lawsuit filed by the Michigan investors and that it would have no effect on Laurelmor.

He said that the market is in a downturn but that Laurelmor would continue.

“We’re in it for the long haul,” he said. “One of the things about us is we don’t sell it and go.… It’s a slowdown in the market, but we’re prepared to see it through.”

About 500 potential buyers attended a sales introduction in November 2006 at Laurelmor. A helicopter thumped overhead, giving tours to potential buyers. Rustic lantern chandeliers hung from 30-foot ceilings inside enormous tents, where hundreds of people dined at lavish buffets.

The developers posted sales on a whiteboard, where they listed 240 lots sold for $150 million. The least expensive lot went for $450,000 and the most expensive for $1.2 million.

But many people who signed contracts didn’t wind up closing on the sales, said Ryan Julison, a Ginn spokesman.

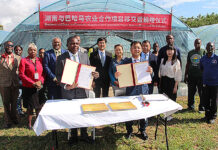

Former Prime Minister Perry Christie talks with Bobby Ginn of Ginn Development.

I hope everyone reads this and understand the background, if they don’t already know what Bobby Ginn stands for, and where any and all of his company’s projects are going.

This is exactly what happend in Hilton Head Island, SC where Mr. Ginn nearly took down the entire Island due to his greed and high life style, personal gain, and spineless individuals that surround him. None of the money is theirs, and why after what he did to Hilton Head Island would anyone ever entrust (loan or promise the funds)these people to ever be allowed to do again somewhere else?

The Ginn Corporation and all of its principles should be in jail, they will never, once again ever complete the projects that they have started. There have been some properties that have finished, but the entire deals have not been paid off, it’s just rob Peter to pay Paul. A tricle down effect if you will! There is a stinky trail behind the horse.

It is really sad that the one’s who lose in this whole deal, is you and me. Watch out, if you hear or see the name or names that have Ginn attached to it, throw this guy and his staff, corporation, companies, or otherwise the hell off your property, Island, or where ever they try to set up camp ever again.

Dear Mike:

You hit the nail on the head! A lot of hype – and high valuations. Then on to resales – how is that going to happen when buyers pay such handsome prices.

V.

Ginns people say that due to the economic slowdown they cannot meet forecast. The real truth is that unethical developers like ginn caused the economic mess that we are in. If you look at the properties going into forelosure at ginn properties they created their own comps in order to artifically drive up prices in their communities. Their greed created this meltdown. I wish one reporter would try to uncover the scheme that ginn mastered. I think you would be amazed.

Comments are closed.