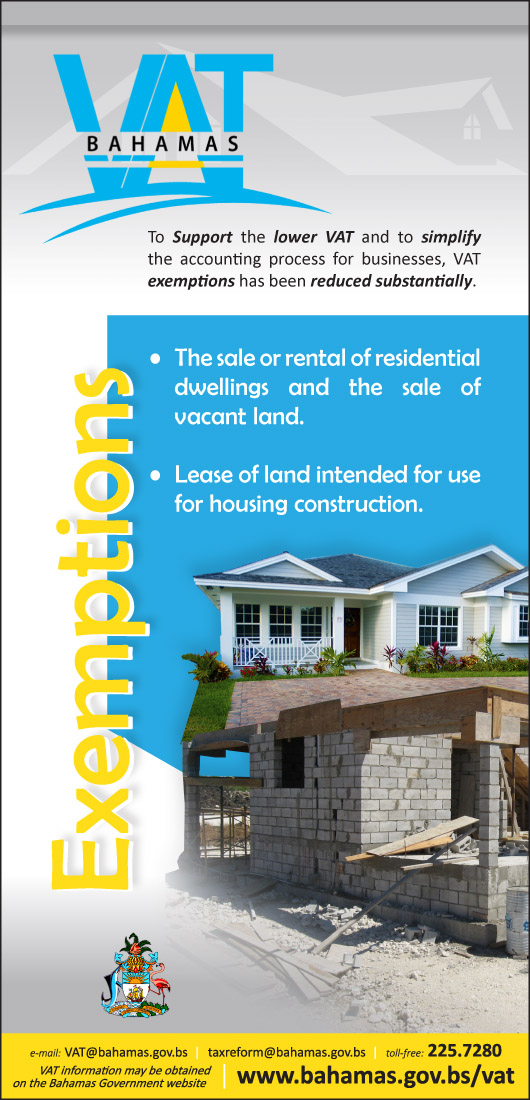

The VAT Department is pleased to acknowledge the progress most vendors have made in complying with requirements of the Value Added Tax Act 2014 to display retail prices that are inclusive of VAT. We take this opportunity to provide information to VAT registrants to help them meet their obligations before the transitional deadline of February 28th 2015.

All registrants must be fully compliant with tax-inclusive display requirements after this date.

If you are a VAT registrant, and make taxable supplies, the prices advertised or displayed must include the VAT. In fact, registrants should be aware that even if the VAT is not included in their displayed prices, the law considers that the displayed price is inclusive of VAT.

How to properly display tax-inclusive prices

VAT registrants must indicate that the price is VAT-inclusive by use of price tags, tickets, bin tags, signs or other methods to display individual prices. For breadbasket items, the price tag must be placed on each individual item. Individually tagging each item with the tax-inclusive price is always an acceptable method.

In order to meet the requirement, you must:

a. State that the price is VAT-inclusive, e.g. “$107.50 VAT inclusive”; or

b. State that the price is VAT-inclusive along with the amount of VAT, e.g. “$107.50, including $7.50 VAT”

The following methods do not meet the requirements for VAT-inclusive price display:

a. A display of a VAT-exclusive price alone e.g. “$100”; or

b. A statement that the price is VAT-exclusive e.g. “$100 (excluding VAT)”; or

c. A statement that the price is VAT-exclusive and that VAT will be added.

Additional Information

The Regulations provide a transitional period until February 28th, 2015 to allow retailers adequate time to make the necessary changes. Given the progress that has already been made by most retailers, the VAT Comptroller anticipates very few situations that would qualify for extension to the time provided.

Vendors who are non-compliant after February 28th should anticipate warnings and/or fines to be applied by the VAT Comptroller, depending on the degree of progress that has already been shown by the vendor toward complying. Registrants should be aware that the law defines non-compliance with these requirements to be a Serious Offence, and depending upon the circumstances, can result in fines as high as $75,000.

Inquiries and Instructions

For additional information, kindly contact the VAT Department at 225 7280 or email us at vatcustomerservice@bahamas.gov.bs

—END—

Top of Page