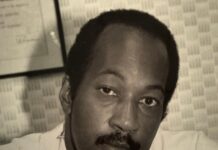

NASSAU, The Bahamas – During his Contribution on the 2024/2025 Budget Debate, on June 5, 2024, Prime Minister and Minister of Finance the Hon. Philip Davis stated that the budget served as a pivot towards a new era for The Bahamas.

“We continue our commitment to fiscal consolidation, to reduce the budget deficit, and to usher in the fundamental changes needed to develop a modern economy that works for the benefit of all Bahamians,” Prime Minister Davis said in the House of Assembly.

He added: “Directly or indirectly, everyone benefits from this budget. As the purchasers of our bonds have benefitted since 2021, so too our citizens have also richly benefitted. It may not land as obviously as tax cuts do, but, given the economic crisis of 2021, we are extremely proud of the fact that our administration did not increase taxes on our citizens. Bahamians were struggling and we were determined to do all that we could not to increase the tax burden.

“And so we launched a strategy not to increase taxes, but instead to focus our efforts on tax collection.”

Prime Minister noted that with in excess of $1 Billion of uncollected tax revenue on the books, the potential was obvious. He added that all Bahamians benefited from the host of additional measures which his Government introduced to revive and stimulate the economy.

Prime Minister pointed out that some of those measures included his Government’s decreasing the VAT rate from 12% to 10%, increasing the minimum wage, and increasing salaries for the public sector employees.

“Additionally, we also reduced VAT on property transactions for Bahamians, expanded the first home exemption programme to include triplexes, and exempted VAT on the construction of homes,” he said. “The Real Property Tax owner exempt threshold was increased to $300,000 and the duty on electric and hybrid vehicles reduced to 10%.”

“Churches, unions and non-profit organizations have also been exempted from the payment of real property taxes,” Prime Minister Davis added. “We also reduced duties on a wide range of building materials and food, including chicken meat.

“This is only a sample of the ways in which Bahamians have benefited from the three budgets which my Administration has implemented. And all of it was done without increasing taxes.”

Prime Minister Davis noted that, while his Government had adjusted some fees to cover the cost of the services that it provided, those fee adjustments over the last three years “pale in comparison to the reduction in taxes that we have provided.”

“Fee adjustments include, for example, this year’s introduction of a new fee to allow for the home delivery of passports for Bahamians residing in the United States, Canada and Europe and other parts of the world,” he noted. “Notwithstanding these adjustments, since coming into office, revenue has grown at a faster pace than the real economy has grown.”

“So, those who point out that we are projecting revenue to grow faster than GDP only need look at our recent experience to understand our confidence,” Prime Minister Davis added. “Our strategy for revenue administration is working.” Prime Minister Davis said that one of the fundamentals which underpinned that was the fact that, at that time, the major revenue driver was the strong inflow from Foreign Direct Investment.

“Foreign Direct Investment is a critical indicator of the confidence which international investors have in our administration,” he noted. “My Government has never planned to burden ordinary citizens with tax increases in order to drive revenue.

“I cannot stress enough how much this has benefited the Bahamian people.”