NASSAU, The Bahamas – The Bahamas Government is offering “modest” but “important” relief to Bahamians as it forges ahead with a decrease in Value Added Tax (VAT) from 12% to 10%.

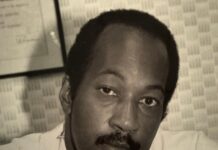

The Hon. Philip Davis, Prime Minister and Minister of Finance in a Supplementary Budget Statement to the House of Assembly Wednesday, October 27, 2021 underscored that the tax reduction is being managed in a way that is fiscally responsible and will help Bahamians and the economy.

“The Ministry of Finance team has worked long hours, along with some of the brightest minds at the University of The Bahamas and the Government and Public Policy Institute, as well as with international consultants, to perform extensive modelling and financial analysis to ensure that the VAT reduction does not adversely affect our fiscal position.

“With the reduction in the VAT rate, we are eliminating the zero-rating under VAT on a variety of items. Price controls are in place to ensure breadbasket items will be fairly priced. The VAT exemption for electricity bills and the special economic zones are untouched,” said Prime Minister Davis.