VAT Implementation plans a smashing success!

Nassau, Bahamas – Since its implementation on January 1st, most businesses have been compliant and have successfully implemented Value Added Tax (VAT) to assist with reducing the government deficit.

Nassau, Bahamas – Since its implementation on January 1st, most businesses have been compliant and have successfully implemented Value Added Tax (VAT) to assist with reducing the government deficit.

To date, over 6,500 businesses have registered.

The Private Sector Education Task Force is pleased with VAT implementation and have been on a media blitz over the past two weeks receiving feedback from the public.

Co-Chairs Jasmine Davis and Edison Sumner along with the other members of the task force – Gregory Bethel and Andrew Rodgers – have continued to encourage consumers, not only in New Providence, but throughout the country to remain vigilant and help to police the administration of the tax.

“This is a consumer tax and so the consumer must do all they can to ensure that they are equipped to recognise inconsistencies when they shop around,” Davis told reporters at a press conference on Thursday.

“If you realise a price is high somewhere, shop somewhere else, it’s that simple. You have the right to spend your money wherever you want to. If you don’t see a VAT Registration Certificate in the business, you do not have to pay VAT. If you do not see a Tax Identification Number (TIN) on your receipt where the recipient has charged you VAT, report it to the VAT Department. We as consumers will be the first line defenders and the ones to police effective and efficient execution of the VAT.”

As stated earlier, task force members have appeared on several radio talk shows where they noted concerns from consumers and have reported them to the VAT Department.

The concerns included VAT on gas prices, how VAT should be applied in restaurants, VAT on educational services, how VAT is applied to banking fees among other issues.

So for example with gas, VAT is already included in the price which means that when you ask for $20 gas you should pay that amount. Once you receive your receipt, you should receive a breakout of how much of the $20 went towards VAT.

Also, if you are dining at a restaurant and your total bill is $100 for the food, your gratuity and VAT should be on the $100 – 15% and 7.5% respectively. This means your gratuity would be $15, your VAT would be $7.50 and the total bill would be $122.50.

Members of the task force implore consumers to flood the VAT Department’s hotline with calls at 225-7280 or email them at vatcustomerservice@bahamas.gov.bs. Consumers are also being encouraged to visit the VAT website at www.bahamas.gov.bs/VAT where information is being updated consistently including the list of businesses registered for VAT. The website also has a complete list of businesses eligible to register for VAT.

“We are noting your concerns and so are department officials,” Sumner added.

“Letters have already been taken to businesses by compliance officers from the VAT Department and fines are being issued to companies or businesses who are finding themselves in contravention of the law. The government is serious about the enforcement of the law governing the tax which will benefit us all. Consumers must also be aware that this is a transition period for everyone; it is new to all of us and there will be some bumps and hiccups along the way so adjustments will be made.”

The VAT Department is currently working on a consumer handbook which is expected to be released to the public soon as a guide.

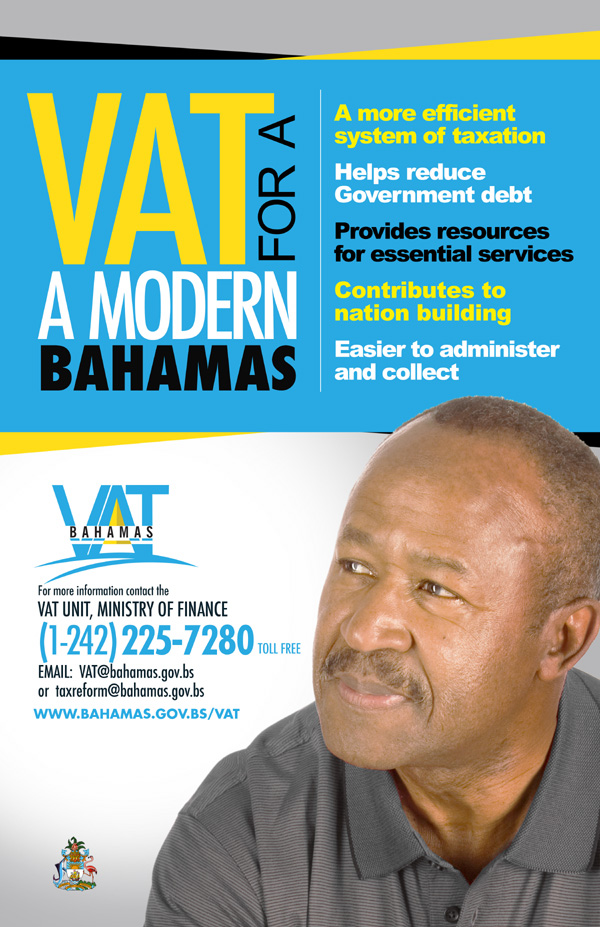

VAT came on stream in January to help cement the government’s program of public finance reform and reduce a debt burden that diverts funds from essential services such as education, healthcare and sanitation services.

For more information contact the VAT Department at vatcustomerservice@bahamas.gov.bs or call the Help Desk Hotline at 225-7280.