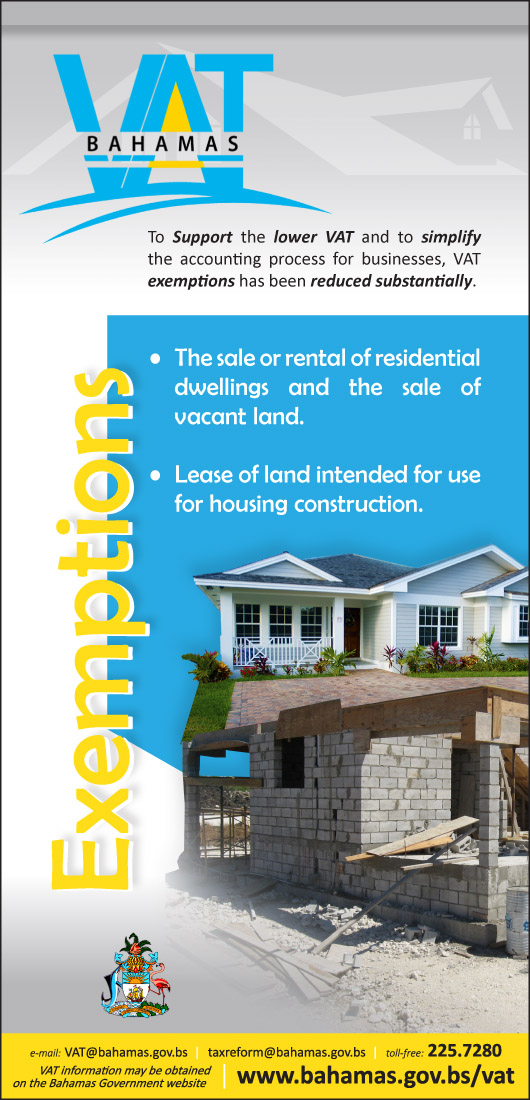

Breaking VAT Update 》》》FOR IMMEDIATE RELEASE

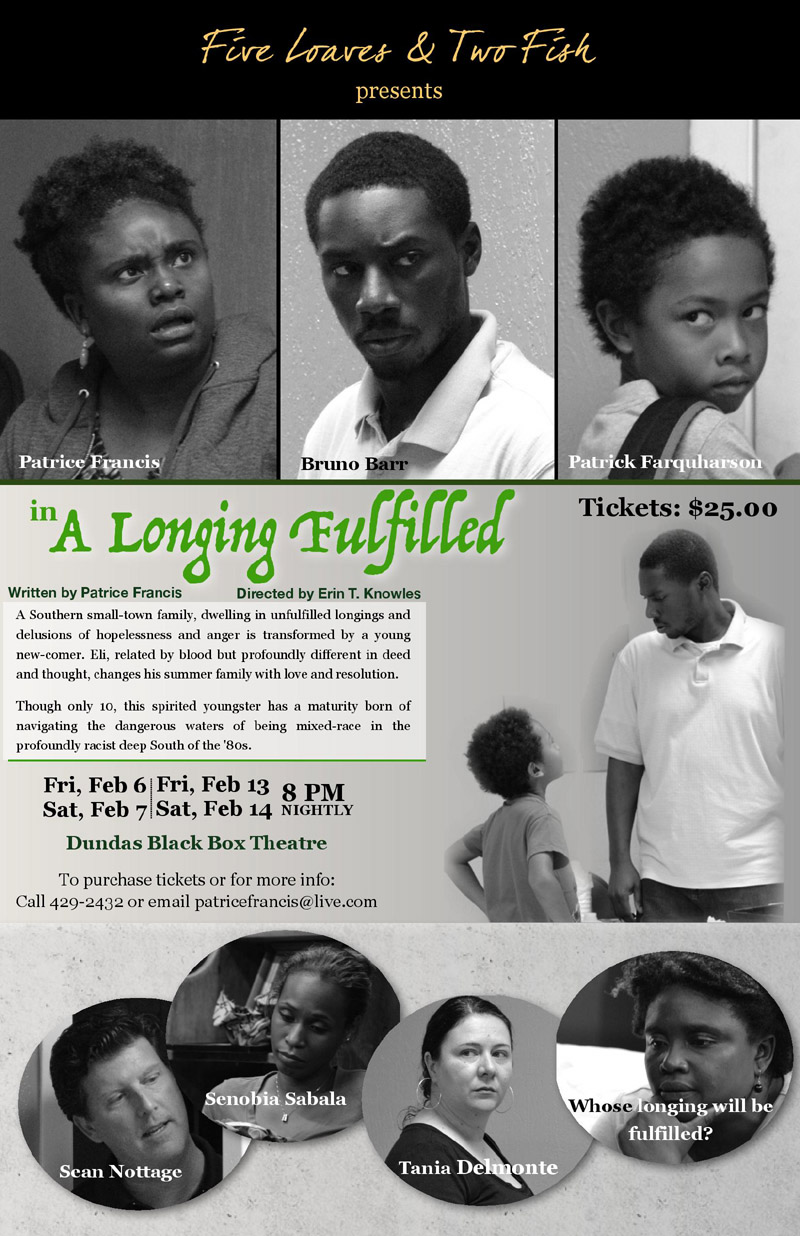

The Ministry of Finance’s Value Added Tax (VAT) Department wishes to advise any person conducting events for the purposes of public entertainment which will generate income from ticket sales and other revenue related activities that they must apply to the VAT Comptroller for registration before advertising the activities.

The Ministry of Finance’s Value Added Tax (VAT) Department wishes to advise any person conducting events for the purposes of public entertainment which will generate income from ticket sales and other revenue related activities that they must apply to the VAT Comptroller for registration before advertising the activities.

These public entertainment activities include sporting events, cultural events, dinner parties and balls. A promoter includes non-profit organizations, religious organizations and charities.

Applicants must complete the normal registration form along with Form 41 – Notification of a Public Entertainment Event at least 48 hours before the event is advertised. A bond is required to secure the anticipated VAT.

VAT Returns should be filed seven calendar days following the completion of the activity.

For more information visit the government website at www.bahamas.gov.bs/VAT or contact the VAT Department at vatcustomerservice@bahamas.gov.bs or VAT Client Services at 1-(242)- 225-7280

February 5th, 2015