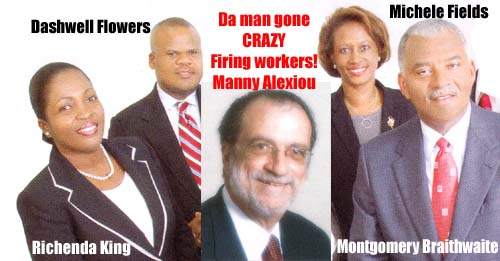

Nassau, Bahamas: ColinaImperial, the parent company of the Nassau Guardian, has finally sacked its former president Monte Braithwaite. Bahamas Press reported on July 16th, 2008, that the entire executive management team at the Insurance giant had been FIRED.

Nassau, Bahamas: ColinaImperial, the parent company of the Nassau Guardian, has finally sacked its former president Monte Braithwaite. Bahamas Press reported on July 16th, 2008, that the entire executive management team at the Insurance giant had been FIRED.

However, a day following the dismissal of the entire executive, the ‘toilet paper’ in an interview with now former President Braithwaite said he was not going anywhere. He reported to the ‘toilet paper’ that he was still on staff at the ColinaImperial Insurance Giant.

We all now know Colina controlling much of the media in the Bahamas, and therefore we expected nothing less but a WUTLESS response from them. However, BREAKING NEWS coming to Bahamas Press now confirms that Braithwaite was kicked out in December 2008 and sent home for GOOD!

Our question to the current executives at COLINAIMPERIAL is this, WHAT WENT SO TERRIBLY WRONG AT THE LARGEST INSURANCE COMPANY HERE IN THE BAHAMAS, TO WARRANT SUCH A MASS EXODUS OF THE ENTIRE MANAGEMENT TEAM?

We knows the days leading up to the collapse of CLICO Bahamas, many financial institutions in the country began moving money OUT OF ACCOUNTS. And again we wondered why?

Days before we broke the news of the executive team exodus at ColinaImperial, every policy including our pension fund held at the company was withdrawn. For as mama once told us on the island, “Son, be careful who you do business with, because the world is filled with TRICKY MEN!

AMEN!

Hi Drama, this man is very, very dangerous and he does not believe in God. I would not want to be in the same room with him.

Kim,

Manny is a snake for real. Anyone who trusts him is foolish after all these warnings from Bahamas Press. Manny brings out every sense of the saying, “Wolf in Sheep’s Clothing”. He operates just like a snake. Like Ossie Brown’s girlfriend is doing, Manny’s wife better sleep with one eye open.

Manny is full of tricks and anyone placing faith in him will be in for a rude awakening. Monty should of know better than to trust this wicked snake, who told him that his job was secure until he reaches retirement. A reverend that used to work at the company recently learned about Manny dirty ways too. Today, she doesn’t even want to hear his name call around her. Now Manny has promise the staff at Colinaimperial that their jobs are safe and they have nothing to fear, if they believe him they will be in for a rude awakening like Monty and that reverend who got swing big time! That’s the way he operates, he would gain your trust and then turn around and chop your neck off. Many people were left bleeding at the hands of Manny.

CLICO (Guy) policyholders protected

By Stabroek staff | March 4, 2009 in Local News -President restates

Even in the aftermath of Monday’s announcement by Bahamian Prime Minister Hubert Ingraham that there currently appears to be no record of CLICO (Guyana)’s investment in CLICO (Bahamas), President Bharrat Jagdeo says that all customers of the local firm are protected.

Lone skeptic… President Bharrat Jagdeo in Barbados recently

The Head of State emphasised that government is implementing measures that will ensure that the investments of all the policyholders are protected and stated that this includes the $6B in funds invested by the National Insurance Scheme (NIS). He was speaking at the Timehri airport yesterday prior to leaving for the US. The President’s assurance would amount to a bail-out by the government if CLICO (Guyana) is unable to retrieve its US$34M investments from The Bahamas.

In relation to the statement made by Ingraham, Jagdeo said that the statement needed to be carefully examined and he noted that Ingraham had not said that there were no records but he had been very specific in saying “at this time”. Jagdeo said that he has been assured by the local management of the CLICO that they have documentation of various transactions conducted with CLICO (Bahamas) and the Head of State expressed confidence that the matter will be resolved in time.

However, the President said that if it is discovered that the information given by the management of CLICO (Guyana) was inaccurate, the local directors and management will be prosecuted.

Meanwhile, the President asked the policyholders for some time for proper verification to be made of the current situation facing the local CLICO company.

Jagdeo stated that Finance Minister Dr Ashni Singh will issue a full statement in relation to the Government’s handling of the matter with CLICO (Guyana) to the National Assembly.

Meanwhile the President said that it is important that the Heads of State of the various territories which have CLICO operations meet. He said as soon as he heard of the woes of the CL Financial Group – CLICO’s parent company – in Trinidad at the end of January and the government’s action there he felt that such a meeting was necessary.

He said that even though he was in Switzerland at the time, he made efforts to contact the Heads of State of Trinidad and Tobago, Barbados and Bahamas. He was only able to communicate with the Bahamian Prime Minster at the time.

But Jagdeo added what is perhaps more integral at this particular time is the meeting of various regulators and Governors of Central Banks, which he said should occur even before the Heads of State meet. He expressed concern that the local regulators of the various territories seemed to be operating in isolation.

He also expressed his disappointment at the manner in which The Bahamas handled the issue with the liquidation of CLICO (Bahamas).

He said that the Bahamian regulator had failed to contact Guyana before making the decision to do so, although that person was instructed by the Bahamian Prime Minister to do so. Jagdeo said last week that the sudden move by the authorities in Bahamas had forced the government to place the local CLICO Company under judicial management. Guyana has invested the $6.9 billion (US$ 34 million) in CLICO (Bahamas) which represented 53 percent of the firm’s assets.

The suddenness of the Bahamanian move might indicate that the authorities in the two countries had not been in frequent and detailed consultation on how to stave off the collapse of both companies.

Meanwhile, the C L Financial fallout spread to another Caricom country last week.

CLICO (Belize) has now been placed under the supervision of the Supervisor of Insurance following the liquidation of CLICO (Bahamas). Following the decision made in

The Bahamas last week Tuesday, the Supervisor of Insurance in Belize moved the next day to have the company come under her control. According to a report, the Supervisor “exercised her power of intervention pursuant to section 53 of the Belize Insurance Act, Act No.11 of 2004 and placed restrictions on the company under section 55 of the said Act.”

The restrictions restrict the company from: (1) issuing any new insurance contract but allows the company to continue servicing existing insurance contracts (which were in effect prior to 25th February); (2) from varying any existing contract; (3) from repatriating any funds out of Belize; (4) from disposing any of its assets without the prior written consent of the Supervisor of Insurance”. Further, the Supervisor of Insurance has secured the assets of the company in Belize and is in full control of the statutory reserves of the Company.

According to the report, the Supervisor of Insurance is in constant dialogue with the Registrar of Insurance Companies of the Bahamas and will be meeting with the appointed Liquidator next week.

Comments are closed.